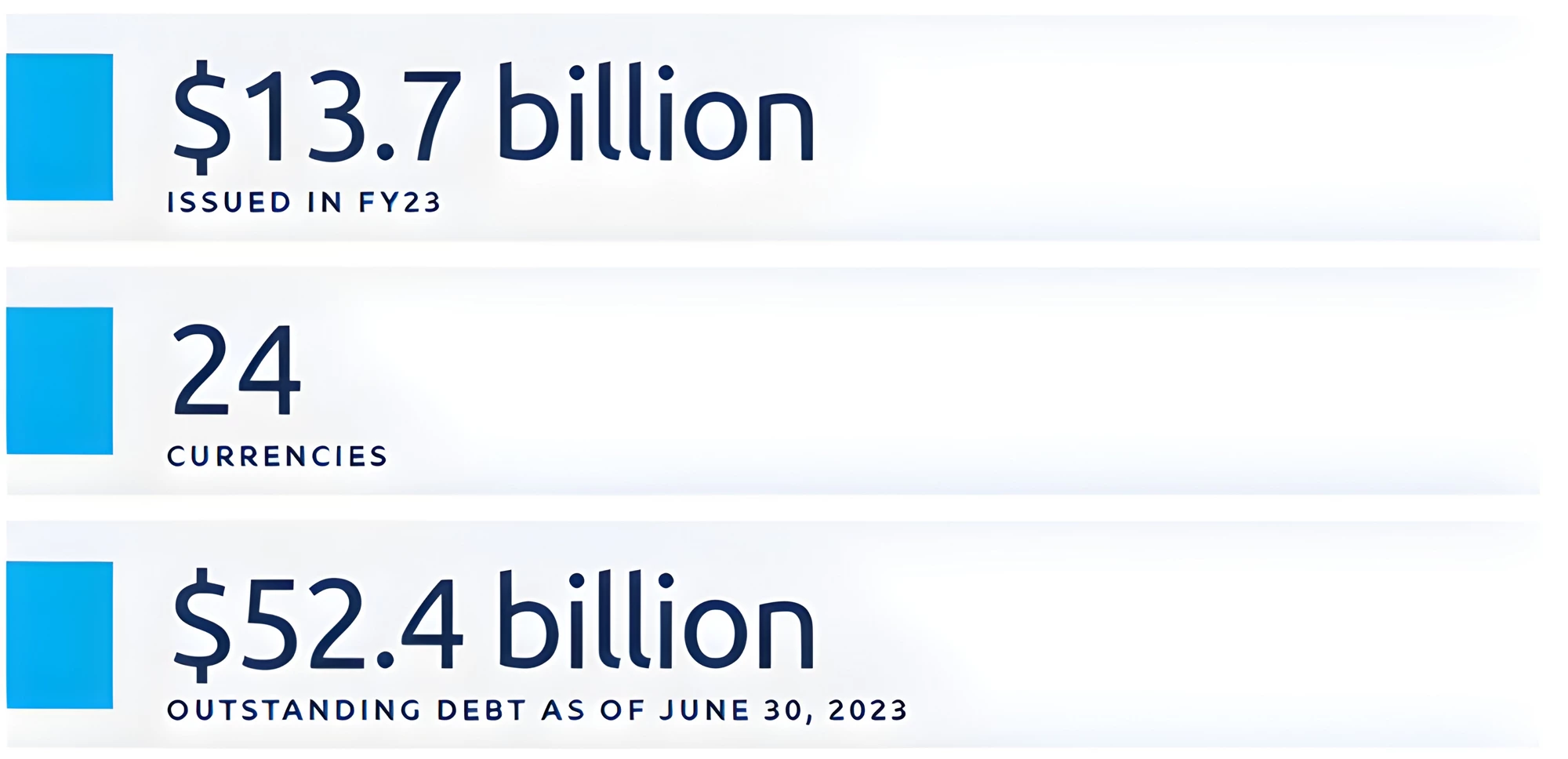

IFC maintains a strong track record with a 0% risk weighting under the Basel Framework. Since 1989, we have consistently garnered triple-A ratings. IFC's lending activities are predominantly funded through a diverse portfolio of benchmark and tailored debt products across various currencies.

At a Glance

IFC’s Funding Program

By investing in IFC's bonds, investors play a vital role in supporting the achievement of the UN Sustainable Development Goals. As part of the World Bank Group, IFC is dedicated to ending extreme poverty and boosting prosperity on a livable planet. Through direct investments, private capital mobilization and advisory services, IFC provides private sector solutions that aim to promote sustainable and inclusive economic growth in emerging markets.

IFC's Sustainable Bond Program

At IFC, our investments aim to create positive impacts alongside financial returns. Our robust ESG framework and Performance Standards have earned us a triple-A rating from MSCI. We have committed to aligning all investments with the Paris Agreement starting in July 2025 and set an ambitious target to devote 45% of our annual financing to climate by 2025. IFC's Use of Proceeds guidelines reflects our development mandate and commitment to sustainability.

IFC’s green and social bonds are an integral part of our borrowing strategy. The bonds are issued as senior unsecured debt, consistent with the overall funding program.