The Ripple Effect of Saving Water

How blue finance is helping the private sector in Türkiye to relieve the pressure of water scarcity.

- Türkiye is under high levels of water stress, with 40-80 percent of its renewable water supply used annually.

- Development financing provides an opportunity for the private sector to address water scarcity and challenges around it.

- A blue finance loan by IFC to Yapı Kredi Leasing has improved water efficiency in Türkiye’s industrial sector.

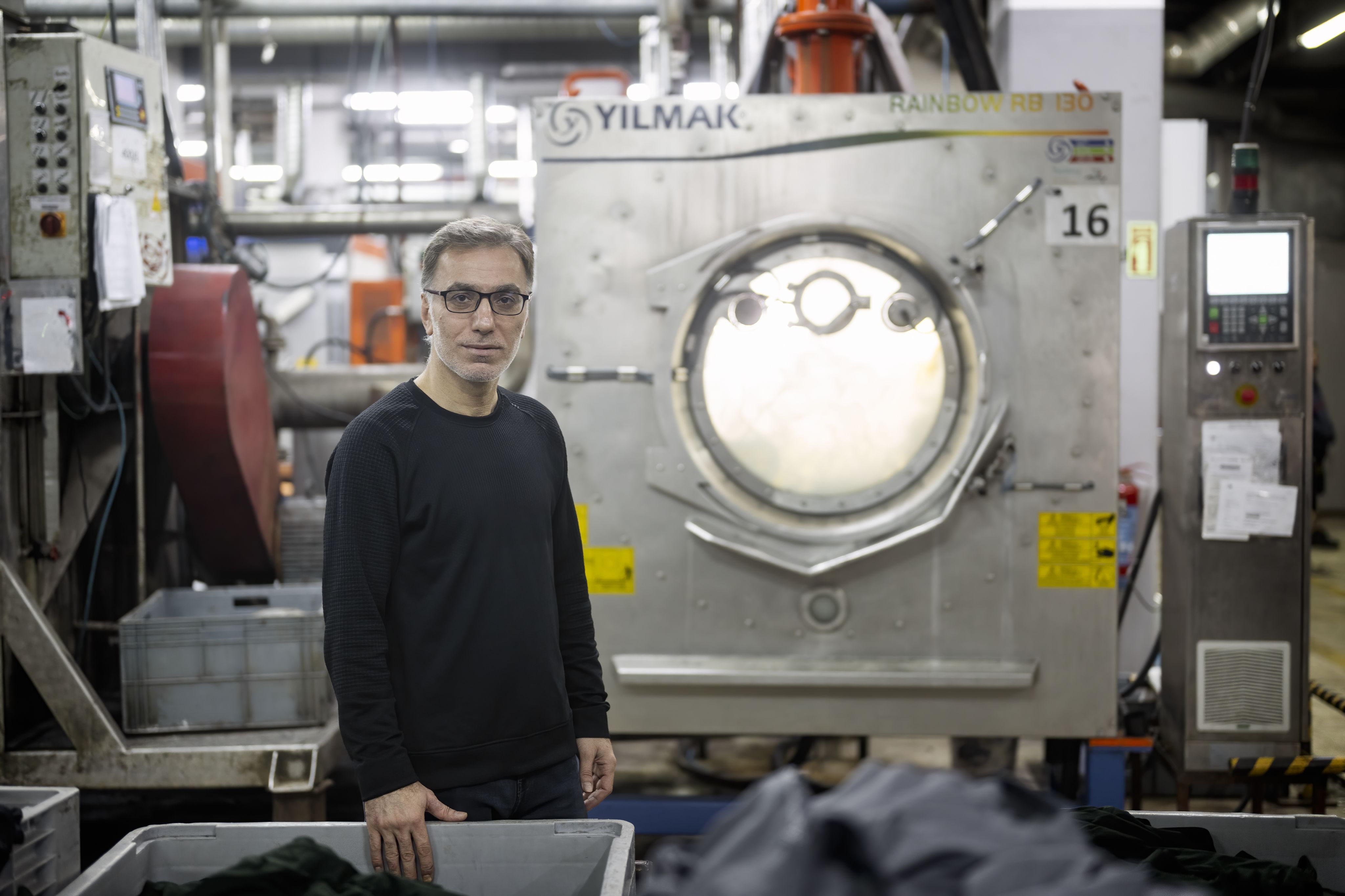

In a factory on the outskirts of Istanbul, surrounded by mountains of white fabric, Harun Aydın takes pride in the soothing hiss and rumble of his machines at work. Back in the day, it would take a ton of water for his company to dye 100 kilograms of fabric. Today, with the gleaming new machinery installed in his plant, it takes less than one-quarter that much.

“The new equipment has had an extremely positive impact on our work” says Aydin, Manufacturing Manager for Kaliteks Boyama Sanayi ve Ticaret A.Ş (Kaliteks), an industrial dying company.

For a small business like Kaliteks, being able to acquire new, more efficient machinery not only stands to benefit the company’s bottom line and improve working conditions for employees but can also play a central role in addressing worsening water scarcity issues in the country.

Blue finance, an emerging area of climate finance, has been able to mobilize private capital to support the private sector whilst also helping to fund the transition toward a more efficient, resilient, and sustainable use of water resources.

Water challenges in Türkiye

Over the last two decades, Türkiye has achieved significant economic and social development progress, becoming the world’s 17th largest economy, increasing Gross National Income per capita over threefold and reducing the poverty rate from 44 to 18 percent. Underpinning this success was the transition of a large swathe of the economy from agriculture to manufacturing and services, and increased support for the dynamic private sector.

These development achievements have been accompanied by industrialization and urbanization that placed additional pressure on the country’s already low per capita water potential with 40–80 percent of the renewable water supply being used annually. While water availability is generally sufficient now, projections for the growth in use may surpass availability by 2030, putting a brake on agricultural and industrial growth, while posing an ongoing risk to well-being.

Water is the source of life. It’s also at the core of sustainable development and economic progress. The availability of quality freshwater is vital for health, job creation, and the environment. However, overexploitation, pollution, and climate change are putting pressure on water resources, from natural pools such as glaciers, lakes and rivers, to man-made water networks that service cities and farms.

For Prof. Dr. Gökşen Çapar, Director at Ankara University Water Management Institute, the current situation can also be worsened by climate change-related “extreme weather events such as droughts and floods, which may threaten urban water supplies as well as disrupt sustainable production in agriculture and industry.”

Due to the water scarcity risks in the country, the private sector often relies on water resources that are under stress or at risk of depletion. In 2022, 71 percent of companies took more than half of their total withdrawals from water-stressed areas, an almost twofold increase on the previous year.

“Improving the efficiency of industrial water consumption is of vital importance,” says Dr. Çapar. “There is an urgent need to prioritize more efficient production methods in industrial plants so that we can address water scarcity.”

Without major investments in the efficiency of production methods, demand may outstrip supply by 2030, hampering agricultural and industrial growth and threatening the health and wellbeing of some 50 million people – upwards of 60 percent of the population.

Blue Finance

It is upon this backdrop that the blue finance sector has emerged. Utilizing financial instruments, such as blue bonds and blue loans, to mobilize the enormous potential of the private sector and unlock trillions of dollars for blue projects can help industrial production to become a key pillar in preserving and growing clean water resources.

In 2022, IFC made the first blue loan in Türkiye, a groundbreaking $120 million loan to Yapı Kredi Leasing, a leading Turkish leasing company. This loan has allowed them to provide financing to 60 blue and green projects so far, with this number expected to grow, including upgrades to more energy-efficient equipment for businesses like Kaliteks.

In the same year IFC also published the Guidelines for Blue Finance to help develop global standards for project eligibility criteria, translating blue economy financing principles into practical guidance for financial institutions for blue bond issuances and blue lending.

"We are proud to have signed the first blue loan agreement with IFC in Türkiye, which is in line with our country's Paris Agreement target," said Fatih Torun, General Manager of Yapı Kredi Leasing. "With this resource, we want to help our country reach its climate targets by supporting SMEs in their transition to green energy."

“IFC recognizes that water is an essential resource at the center of efforts to mitigate, adapt and build resilience around climate change. Our work with clients such as Yapı Kredi Leasing aims to strengthen our development of innovative and market-oriented solutions to water infrastructure challenges,” said Wiebke Schloemer, IFC’s Director for Türkiye and Central Asia.

Improving water efficiency, improving business

Back in the outskirts of Istanbul, the impact of Türkiye’s first blue loan has been significant. Hülya Erdoğdu, Head of Accounting and Finance for Kaliteks, says “being able to lease machinery from Yapı Kredi Leasing allowed us to utilize equipment that would have been problematic to purchase.”

Aydın, the manufacturing manager, nods in agreement and glances across the shop floor. The impact, he explains, has not only been felt on the company's balance sheet but has also flowed to their people. When using the old machines, workers would have to climb into them to collect materials upon completion. A tilt function on the new devices has removed this requirement. Alongside fail-safe protections when hot water is in use, this has created a less strenuous, safer working environment.

“The new machines have significantly improved working conditions for our employees,” says Aydın.

For small and medium-sized enterprises like Kaliteks, blue finance has not only improved water efficiency, but is having a positive impact across the business. The new machines have reduced costs and positioned the company to move into new market segments.

With so much water saved, the company is now looking at a bright new blue horizon.

Published January 2024