"It's Our Responsibility to Go Green"

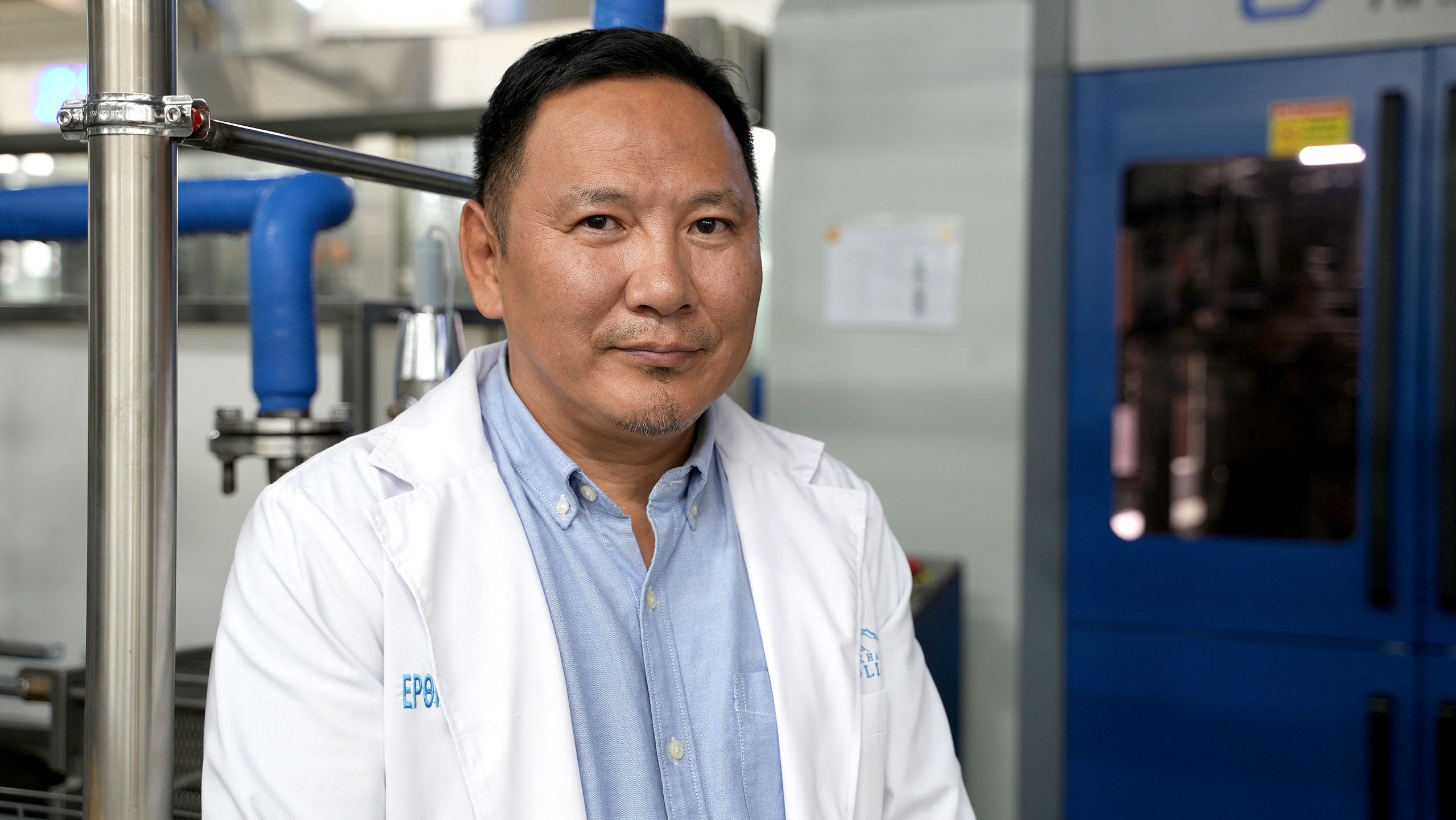

A Mongolian CEO demonstrates how the country's first green bond supports climate-conscious growth.

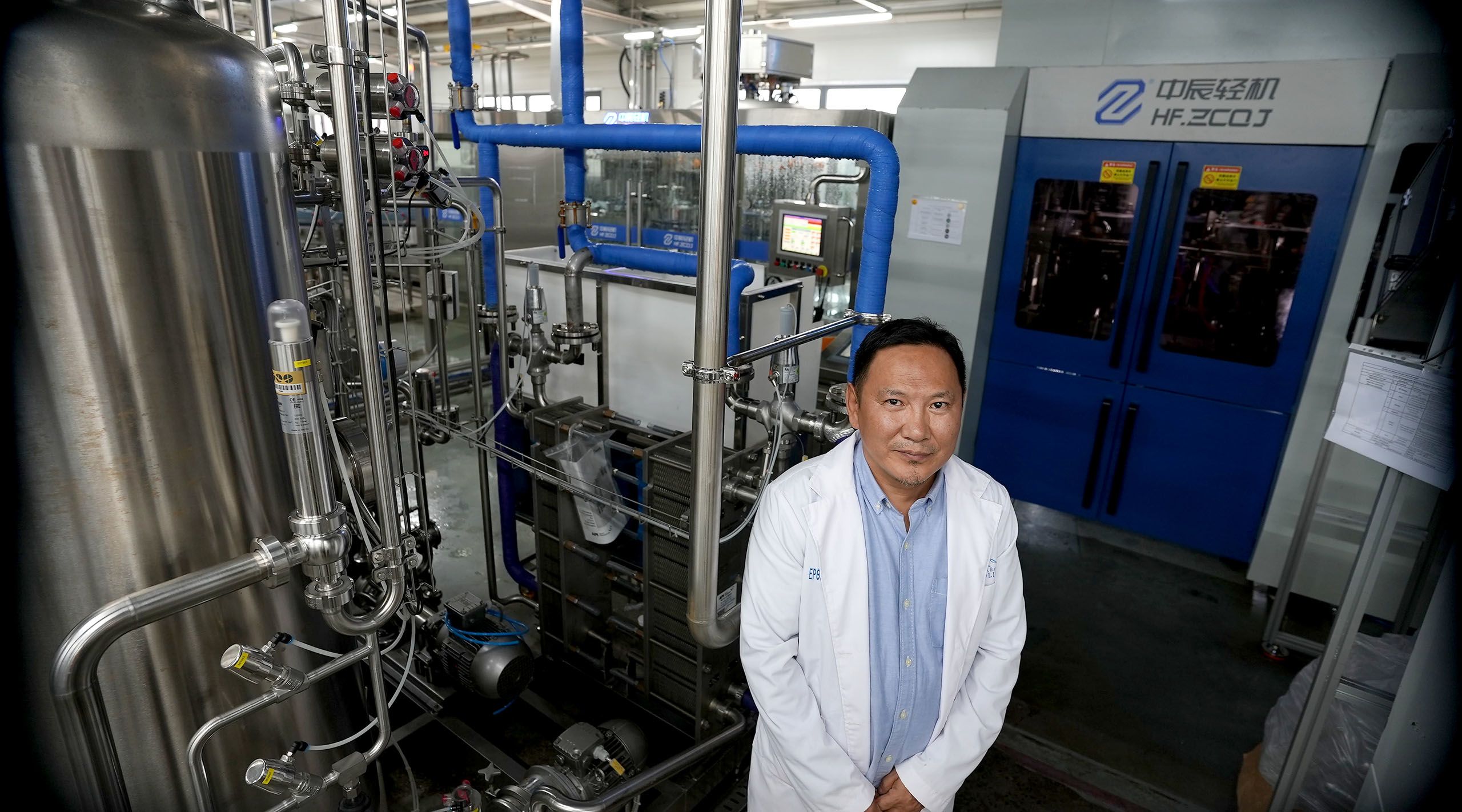

When the 26.8-ton CombiBlock roars to life—mixing, blending, and pumping water for beverage production that used to be done manually—the factory floor of TSK, a beverage company on the outskirts of Ulaanbaatar, bustles with activity. Workers position themselves around the L-shaped machine while operators at the digital control panel punch in neon-colored commands. The company’s owner, Erdenebayar Jamiyansengee, monitors the action from a few feet away.

“It was always my dream to purchase the CombiBlock,” he says. “I saw it when I toured other beverage plants in China and Europe, and I wanted the energy savings and the productivity gains here in Mongolia as well.” The machine combines seven processes into one, resulting in faster production as well as significant energy savings.

Although TSK procured the CombiBlock in September 2023, installing product lines to test the 22 types of new beverages that were part of the company’s expansion plan required another significant investment. So when Mongolia’s Khan Bank began offering its clients green loans with the proceeds from a green bond launched with IFC support, TSK saw its opportunity. After Khan Bank approved the loan, production of TSK’s new beverages started this fall, with waters flavored with mint, berries, and cucumbers, all of which are sourced from local producers.

The CombiBlock, with the new product lines, has already increased TSK’s productivity by 85 percent, from 10,000,000 to 18,500,000 bottles per year; energy consumption per unit of output is reduced by 23 percent per bottle. “I feel strongly that from a corporate social responsibility perspective, we had to go green and use more efficient technology,” says Erdenebayar. “We already see a big time and energy savings, and our goals are within our reach.”

Climate-conscious growth

Erdenebayar founded TSK in 2008 because “I wanted Mongolians to be able to buy things that are made here,” he says. The firm has grown continually since then. Most recently, in 2019, the factory expanded from 2,000 square meters to 3,500 square meters. In 2020 it built two new laboratories on-site so the company can guarantee its products comply with national standards.

Throughout, TSK has taken significant steps to conserve energy, as when it installed pipes underneath the floors to capture and store steam before converting it into water that powers the factory’s HVAC system.

As TSK developed ambitious plans to introduce new water, juices, and sodas, Erdenebayar strove to assure that energy consumption and costs did not grow proportionally with the greater productivity that was critical to expansion. That was part of the reason the CombiBlock was such a good choice for the factory, he recalls. It replaced three separate, energy-guzzling pieces of equipment, as well as the need for employees to manually haul water to the factory floor.

TSK’s demonstrated focus on energy savings was part of the reason that Khan Bank’s green loan was a good fit, says Javkhlan Otgonsuren, a green finance specialist at Khan Bank. “The bank selected clients that already had equipment procured and installed, like TSK, so it could put the loan to immediate use.”

Support for a local business like TSK is important in Mongolia, where small and medium-sized enterprises account for approximately 70 percent of the workforce and contribute 17.8 percent of GDP.

TSK will eventually need to double the size of its 75-person workforce because of heightened productivity, according to the CEO.

TSK will eventually need to double the size of its 75-person workforce because of heightened productivity, according to the CEO.

Despite this, they face hurdles in securing financing, according to Jack Sidik, IFC Country Manager for China and Mongolia. That's why, he says, “We have introduced innovative instruments such as green bonds and social bonds to help attract the investment needed for Mongolia’s climate and development goals.”

Contributing to a green Mongolia

Now that TSK’s CombiBlock is operational, the company’s monthly energy savings are significant, Erdenebayar says. “We have to preserve energy everywhere we can,” he stresses, remembering a time when energy shortages in Ulaanbaatar made it difficult for the factory to get the electricity, heating, and steam it needed for production.

Although small and medium-sized enterprises account for approximately 70 percent of Mongolia's workforce and contribute 17.8 percent of GDP, they face obstacles procuring financing.

Although small and medium-sized enterprises account for approximately 70 percent of Mongolia's workforce and contribute 17.8 percent of GDP, they face obstacles procuring financing.

As production speeds have accelerated to 200 bottled drinks per minute—a significant jump from 33 bottles per minute with the old equipment—Erdenebayar predicts that TSK will eventually need to double the size of its 75-person workforce. When that happens, he says, the company will be better positioned to export TSK’s products across the region. Though it already sells to over 2,000 Mongolian shops, restaurants, grocery stores, and markets, offering products across borders will prove that the country has the manufacturing capacity and the know-how to grow responsibly, Erdenebayar believes.

“This is our contribution to a green Mongolia,” he says.

IFC’s anchor investment in Mongolia’s first green bond has helped attract $45 million from international investors, including $35 million from FMO, the Dutch entrepreneurial development bank, and $10 million from MicroVest Capital Management. IFC also helped Mongolia develop and adopt the Environmental and Social risk management requirements for commercial banks. IFC, with support by the Government of Japan through its Comprehensive Japan Trust Fund (CJTF), supported the formulation of Mongolia's Green Bond Regulation and Guideline documents, enabling the issuance of green bonds in the local market.

Published in December 2024