By Alison Buckholtz

Santiago Zavala, a partner at 500 Luchadores, a regional Latin American investment fund in Mexico City, describes his group of portfolio companies during COVID-19 as a race car speeding on a highway–just before it approaches a sharp bend.

“The driver slows down to gain control, navigating the dangerous turn carefully so he can gain traction, emerge safely on the other side of the threat, and speed up again,” Zavala said, pausing for effect. “That’s exactly what our companies are doing right now.”

Zavala’s investment fund–known as an accelerator because in addition to money it offers strategic, marketing, and networking help for each batch of start-ups it accepts–is one of many funds in emerging markets that nurture and strengthen start-up companies. A start-up that makes it through the competitive screening process and is accepted by one of these funds has access to resources that can be key to its survival.

But in an era of economic uncertainty, and with travel restrictions changing the way investors evaluate promising investees, funds’ expectations for their portfolio companies have changed dramatically. From Latin America to the Middle East to South Asia, accelerators and seed funds are adjusting their strategies to assess and support start-up companies during COVID-19—igniting trends and introducing products that may remain long after the pandemic fades.

Start-ups with innovative solutions to COVID-19-era challenges have already pivoted to serve critical needs.

“It’s never been more important to be nimble,” said Manish Singhal, a founding partner of Bangalore-based pi Ventures. Like Singhal, several other directors heading up investment funds throughout emerging-market countries say that the COVID-19 crisis is forcing them to refine their criteria for investing in start-ups and reevaluate what success looks like.

Manish Singhal of pi Ventures. Photo courtesy: pi Ventures.

“Back to Basics”

Accelerators and seed funds fall under the umbrella of venture capital, or VC. VC funds pool investor capital and invest equity stakes in small and medium-sized enterprises (SMEs) with strong potential for growth. In addition to contributing capital, many accelerators and seed funds offer development and management expertise to start-up founders. For start-up founders in emerging markets—where opportunities for entrepreneurs to be nurtured are not as plentiful as in other economies, and capital may be scarcer—being accepted by an accelerator or seed fund could enable them to rise above the pack.

Although Ibtikar Fund, a five-year-old seed fund based in the West Bank city of Ramallah, is used to challenges, the pandemic took all companies by surprise, said Ambar Amleh, Partner at Ibtikar Fund. Immediately after the lockdowns in the region began, the firm worked with each of their portfolio companies and planned for different scenarios, including a deep look at their cash positions and financial runway.

“As an early-stage investor, we work very closely with our portfolio. Given the unknowns surrounding COVID-19, we doubled our efforts to make sure that our portfolio was prepared to weather these challenges,” she said.

Ibtikar’s Ambar Amleh (right) says the pandemic may speed up access to digital payment options in the Middle East. Photo courtesy: Ibtikar Fund

Before the crisis, the firm was gearing up to fundraise for its second, larger fund, and “was getting great traction,” Amleh said. Today, although fundraising has been delayed due to restrictions on travel and logistical challenges, “the case is stronger for a second fund that capitalizes on the trends that were expedited and amplified, and we believe we will be able to launch our second fund by the end of the year.”

That decision is consistent with other funds’ moves. A survey by Nfx to assess VC and start-up founder sentiment early in the pandemic found that half of all firms are not shifting their investment strategy at all. Additionally, for most firms, working with existing portfolio companies now takes up a bigger chunk of their time. A report from EY predicted that the venture capital funding market will labor under these conditions for the next few quarters.

To thrive, venture capital funds focused on start-ups will need to go “back to basics,” said Balagopal Vissa, Professor of Entrepreneurship at INSEAD’s Singapore campus. “Funds and accelerators that are focused on ‘boring’ sectors like B2B [business-to-business] tech start-ups are more likely to find good opportunities because it is easier in these domains to identify ventures that are actually building solid businesses that solve real problems for their users and customers in a sustainable way. Overall, the trend of ‘back to basics’ will likely amplify.”

Pivoting to Meet Demands

Rabeel Warraich, general partner at Sarmayacar, a VC firm in Pakistan, said he is watching, waiting, and taking a cautious approach to investing. At the same time, though, he is scouting for start-ups “in spaces that might see a behavioral shift in the post-coronavirus world.”

In March, Sarmayacar closed an investment in a start-up that already shows evidence of that shift: Dawaai, one of Pakistan’s largest online pharmacies. Sales spiked after the coronavirus outbreak when people realized they could get medicine and supplies delivered to their homes; Warraich said the company has been doubling sales month to month. Consumer demand will not disappear after the pandemic because “it’s not as if all of a sudden, Pakistan’s serious pharma logistics problems will be solved.” In fact, Dawaai has just begun working with the government to expand to include telehealth services and online medical consultations.

Warraich pointed out that the due diligence process to assess potential start-ups has become much more difficult due to travel restrictions, a feeling echoed by others.

Sales at the online pharmacy Dawaai spiked after the coronavirus outbreak. Photo courtesy: Sarmayacar

“Usually we meet the teams midway through the process to understand company culture, energy, subtle interactions among the founders, and to figure out how invested the employees are,” said Alex Busse, Principal at NXTP Ventures, a seed fund based in Argentina. “Venture capital is 100 percent a business about investing in people. So not being able to get to know founders has been the biggest challenge for us.”

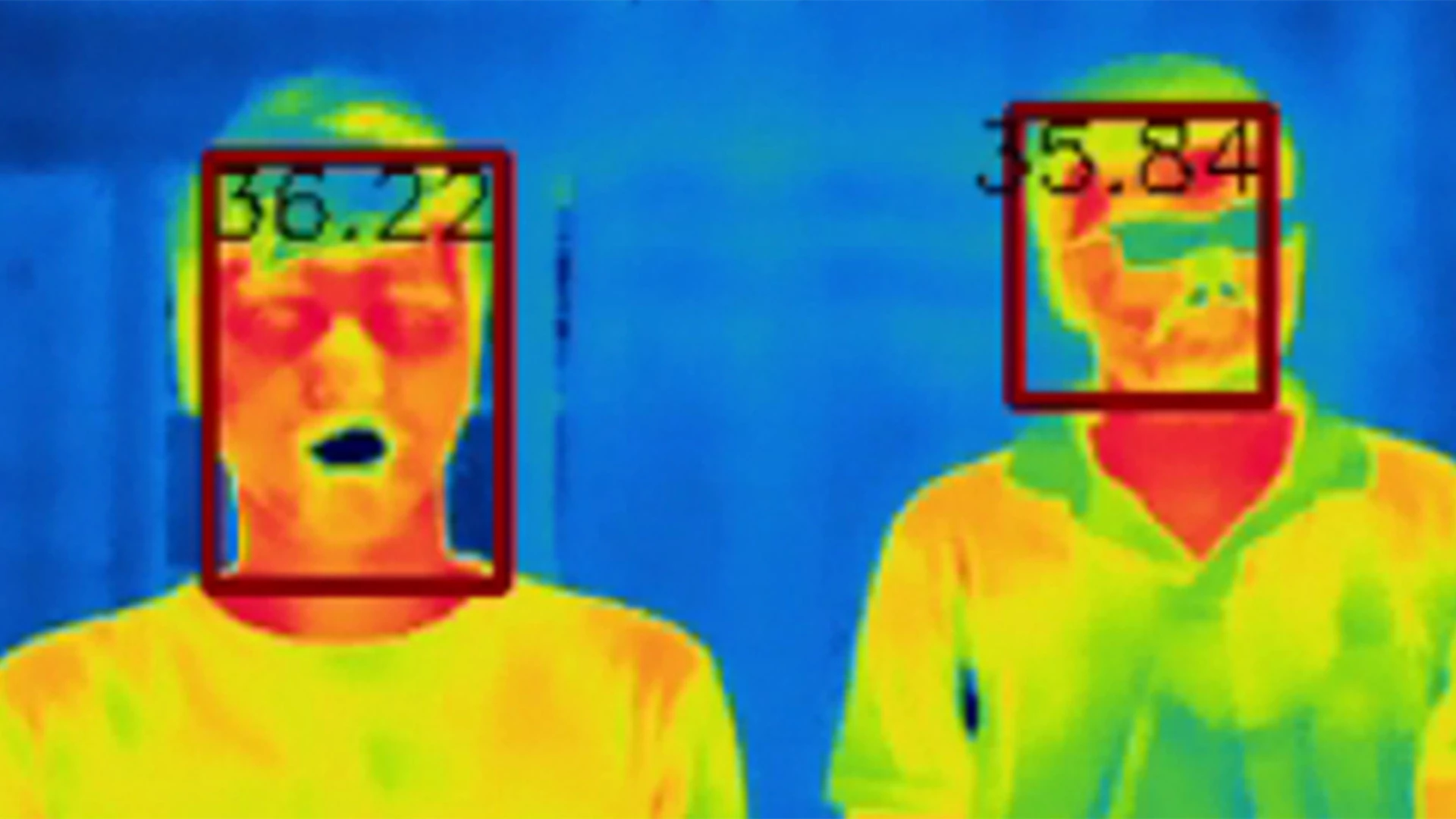

Start-ups that are pivoting to meet new demands—demonstrating to investors a built-in capacity to be flexible—will rise to the top despite such obstacles, said Singhal of pi Ventures. Niramai, one of pi Ventures’ 10 active portfolio companies, saw that the practice of thermal screening—in which infrared forehead thermometers measure the temperature of people in airports, hospitals, and other public places—is not a sufficient signal of COVID-19 infection and risky for the security personnel who perform the screening.

So Niramai’s founders adapted the company’s established AI-enabled breast-cancer screening solution for automatic detection of fever and COVID-19 respiratory symptoms. It involves installation of a high-resolution thermal camera at the entrance of a building. Temperature and respiratory patterns are measured remotely.

“In two or three weeks, the company came up with this new product to answer a need,” Singhal recounted. “We count on entrepreneurs to be agile, and that’s what we saw here.”

At 500 Luchadores, Zavala is also thinking about what post-pandemic societies might prioritize—and that’s altered the criteria for a start-up’s appeal. “Among consumers there’s a focus on safety, efficiency, and essential, practical services, rather than entertainment or luxury. And we’re paying attention to that.”

In fact, one of 500 Luchadores’ portfolio companies recast its entire business model in just over a week to suit the needs of its business clients. ComeBien (the name means “eat well” in Spanish) was a corporate catering platform that delivered thousands of nutritious, hot meals per day to employees at offices across Mexico City. Though revenues were skyrocketing before the pandemic hit, those numbers dropped to zero after home-based work was mandated. In just eight days, the ComeBien founders created a new web site, MuchaComida (“a lot of food”), to deliver individual frozen meals to workers’ homes. By adapting fast, it’s thriving in a brand-new environment, Zavala said.

Argentina-based NXTP Ventures invests in start-ups across Latin America. Photo courtesy: NXTP Ventures

Redefining Success

But for every venture that’s figuring out how to breathe again, others are gasping for air. A travel business in the 500 Luchadores portfolio has begun pre-selling trips for next year—with perks and value-added features—to remain viable. “Because they adapted in this way, they only lost 56 percent of revenue. That’s the difference between closing down and staying open. In a market where everyone else is losing 90 percent, this is success,” Zavala said.

It remains a tense time for start-ups and the funders who have backed them, conceded Amleh, from Ibtikar. But it’s stressful for everyone—and that’s why Ibtikar’s newest investment in Tawazon, the first Arabic-language meditation app, is especially timely. (The name means “balance” in Arabic.) Tawazon has witnessed a surge in downloads and usage since the regional lockdown began.

After sealing the investment deal, Ibtikar staff and Tawazon’s founder celebrated in peak-pandemic style: on a Zoom call.

Published in June 2020