Behind the Seams:

How Fashion’s Sustainability Champions are Funding their Future

Twenty years ago, Vidhura Ralapanawe had a vision of the future. He didn’t like what he saw.

Working as a climate researcher, he saw evidence that today’s economic activities could have a significant impact on the future.

Something needed to change. So Ralapanawe started by changing his job.

“I wanted to be where the action is,” said Ralapanawe, who stood perched atop an industrial causeway, squinting against the sunlight. “You could say I found it.”

Below, a water treatment facility bubbled, one component of an advanced apparel factory located on the outskirts of Dhaka, Bangladesh. It’s one of many owned by Epic Group, the Hong-Kong based apparel maker where Ralapanawe today serves as Executive Vice President of Innovation and Sustainability.

“We’re taking action. This treatment plant recycles around 50 percent of the water this facility uses – by the end of the year, it will be 85 percent,” said Ralapanawe.

Stepping down from the causeway and into the shade of a tree, Ralapanawe is undaunted by the day’s heat. From sourcing to sewing, from water to waste, he lists the dizzying number of reforms made across this facility’s supply chain to reduce its water, energy, and packaging use.

It’s a frank view of the complexities required to transform just one link in the global economy.

Kazi House Productions

Kazi House Productions

As international brands work to meet ambitious sustainability goals, especially regarding emissions by companies in their supply chain, often called Scope 3 emissions, suppliers like Epic are increasingly tasked with making those social and environmental goals a reality.

Already facing the hard realities of limited budgets and thin profit margins, even the most successful suppliers often need access to more affordable financing to achieve their customer’s corporate targets, grow their businesses, and create new jobs.

Two years ago, Epic asked IFC and one of its buyers, Levi Strauss & Co., how they could work together and make that happen.

Epic signed on to IFC’s Global Trade Supplier Finance (GTSF) program, a $1 billion program that provides affordable short-term financing to suppliers – and grants additional discounts on financing costs when a supplier meets sustainability and compliance requirements set out by their buyer.

“Generally, sustainability and profits are not closely linked. And one thing that GTSF does is it links them together,” said Ralapanawe.

Originally launched by IFC in 2014, the program includes international brands in fashion, food, automotives, and electronics. The first sustainability-linked trade finance instrument, it has also spurred other lenders to create similar programs.

But a look at the garment sector, where GTSF first focused, shows how the program remains best-in-class, pairing with impactful IFC advisory services and leveraging IFC’s AAA rating and its highly competitive rates.

“I wanted to be where the action is. You could say I found it.”

- Vidhura Ralapanawe, Executive Vice President of Innovation and Sustainability, Epic Group

On a busy sewing floor of the Epic factory, a spool of thread unravels in a blur of pure motion, transformed by a sewing machine into a neat row of stitches on a pair of pants.

Plastic spools of thread like these were once discarded by the thousands. These days, Epic saves and ships empty spools back to their supplier to reduce waste.

“It’s one of many small practices that add up to something bigger,” said Ralapanawe.

At this factory, IFC played an early role in reducing waste and improving efficiency. In 2016, Epic participated in IFC’s Partnership for Cleaner Textile (PaCT) program, receiving recommendations to improve its water efficiency, reduce its chemicals usage, and trim its emissions.

Epic went through with the recommended upgrades, says Ralapanawe, adding that his company then made an even larger series of improvements to the facility on its own initiative.

“What the PaCT program did for Epic, in some ways, is set the initial foundation for our work on sustainability,” said Ralapanawe.

Kazi House Productions

Kazi House Productions

As Epic searched for ways to turn its hard work into rewards, it became interested in GTSF, and the financial incentives it could earn for its work in improving its sustainability and compliance practices.

Epic found that it would have to make further improvements if it wanted to earn the highest level of financing discounts GTSF offers. “Subsequently we took a very focused course of action,” said Ralapanawe.

Changes, he said, focused on compliance issues, including improving practices around use of personal protective equipment, expanded education for employees on their legal rights, and improvements to labeling of chemical stores.

Those improvements allowed Epic to score 93 points out of 100 on Levi’s compliance-focused Supplier Code of Conduct, and taken together with measures implemented under PaCT, qualified Epic for the lowest interest rate available in the GTSF program.

“There is a clear linkage between the GTSF incentives and how we ended up with a very high performance in our sustainability level,” said Ralapanawe.

Anoma De Silva, Epic's Assistant Vice President of Human Resources, puts it in another way – “GTSF has helped us maintain an attitude of continuously improving our culture.”

“We could go to any commercial bank for a loan. We worked with IFC because we wanted to become a better organization that is around generations from now.”

- Arshad Ali Chowdhury, Chief Financial Officer, Epyllion Group

On the other side of Dhaka, a newcomer to the GTSF program has benefitted in its own way.

Clad in ivy, solar panels, and surrounded by trees, a facility owned by Epyllion Knitwear Ltd looks more like a community college than a traditional garment factory.

Several years ago, this IFC-financed facility won accolades for its sustainable architecture. But keeping operations sustainable is a different challenge.

“There are many advantages to sustainability. But it’s a process. It requires incredible focus and constant work,” said Arshad Ali Chowdhury, Epyllion’s Chief Financial Officer.

Epyllion only recently started to use GTSF, and its buyer is still finalizing its sustainability benchmarks for awarding trade financing discounts. But even in its most basic form, GTSF has still allowed Epyllion to access more competitive rates by leveraging the credit rating of its buyer.

With the savings Epyllion receives from GTSF, Chowdhury said his company has more cash on hand, allowing it to more easily acquire upgrades that can help make the company operate better.

“To reorganize your production process, you want to use your own funds, not go to the bank and ask for a loan that means high interest, and a long approval process,” said Chowdhury. “IFC’s [GTSF] is fairly positively impacting our cash flows, which will help us to actually use our own funds for these capabilities.”

Chowdhury credits the added savings with helping to finance facility upgrades. “For instance, we used our own funds to bring in some machines that have automated steps that used to be very manual processes, like sewing together certain kinds of shirt collars – that has only happened because we used IFC’s trade finance product,” he said.

Kazi House Productions

Kazi House Productions

For Epyllion, sustainability is also about its workforce. Several years back, it participated in the Gender Equality and Returns Program (GEAR), a program that trains women garment workers to progress into leadership roles, and is run jointly by IFC and the International Labour Organization.

Epyllion has continued its own version of the training, helping women with employment opportunities across the organization.

Beyond new equipment and improved practices, working with IFC has helped sharpen the company’s corporate governance, said Chowdhury.

“We could go to any commercial bank for a loan. We worked with IFC because we wanted to become a better organization that is around generations from now,” he said.

“For us, GTSF is a reward, and it’s also a help… It frees up resources so we can do more of the kind of sustainability work we already set out to do.”

Miles Lam, Sustainability Lead and Head of Sales & Business Development for Denim, Crystal International Group Limited

Along one corridor of this facility, machines with vertical lasers sweep across pairs of jeans, leaving an intricately detailed pattern of fades and creases in a matter of seconds.

“Getting these details used to require washing the jeans over and over. Now, using the laser alone saves around 50 liters of water per pair,” said Miles Lam, Sustainability Lead and Head of Sales & Business Development for Denim at Crystal International Group Limited, the parent company of Yida Denim.

Back in 2007, Hong Kong-based Crystal became one of the world’s first fashion suppliers to lay out a dedicated sustainability roadmap.

Kazi House Productions

Kazi House Productions

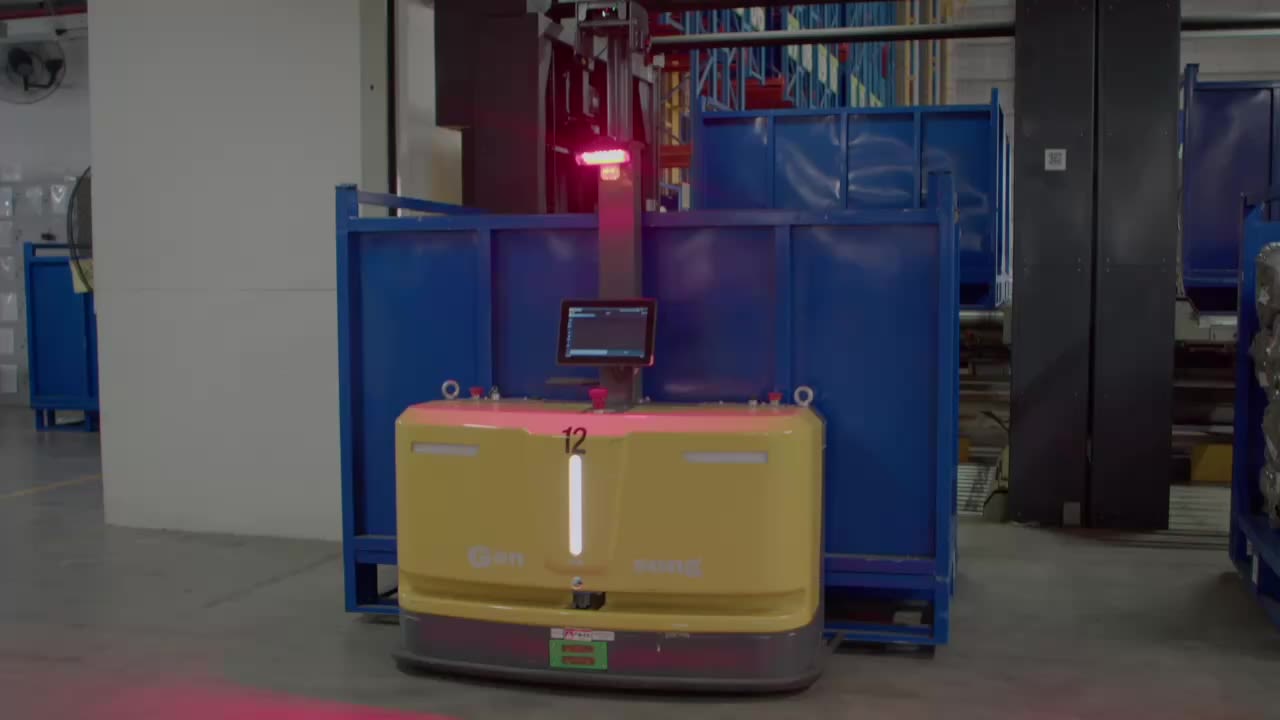

Today, Crystal’s Yida facility boasts a vast smart warehouse, an ultra-efficient water treatment plant, and a series of high-tech washers, faders, and other automated tools that help limit the environmental footprint of denim.

“For us, GTSF is a reward, and it’s also a help,” said Lam. “It frees up resources so we can do more of the kind of sustainability work in both environmental and social dimensions we already set out to do, especially as we progress towards our Net Zero 2050 commitment in the coming decades.”

“My vision of the future is to bring brands, manufacturers, and financial institutions together, so that we have a plan that is fast, swift, and effective.”

Vidhura Ralapanawe, Executive Vice President of Innovation and Sustainability, Epic Group

Back in Bangladesh, the sun is setting over a row of rooftop solar panels at the Epic factory.

As Ralapanawe takes in the view, it’s hard to not imagine him feeling restless.

By 2030, his company aims to reduce its absolute emissions and water consumption by 50 percent against where it was in 2019 – all while pursuing an ambitious expansion strategy.

Within that, Ralapanawe views GTSF like he does the many upgrades in his factory – something that’s highly valuable as part of a larger whole.

IFC earlier this year provided Epic with a $100 million loan to finance its growth plans.

A facility Epic plans to build in India “is a fundamental rethink of how manufacturing facilities should be,” said Ralapanawe, who adds that Epic will need to deliver on ambitious environmental and social performance targets if it’s to earn a discounted rate from IFC.

“All of our expansions will need to function as net zero carbon and net zero water facilities,” he adds.

But Ralapanawe sees even that project as part of a larger whole.

“It's fundamentally important that we address climate change, and that we work together to do it,” he said. “My vision of the future is to bring brands, manufacturers, financial institutions, service providers, all these partners together, so that we have a common agenda, a common action plan that is fast, swift, and effective.”

Published in April 2025

Further Reading