Shelling Out Success

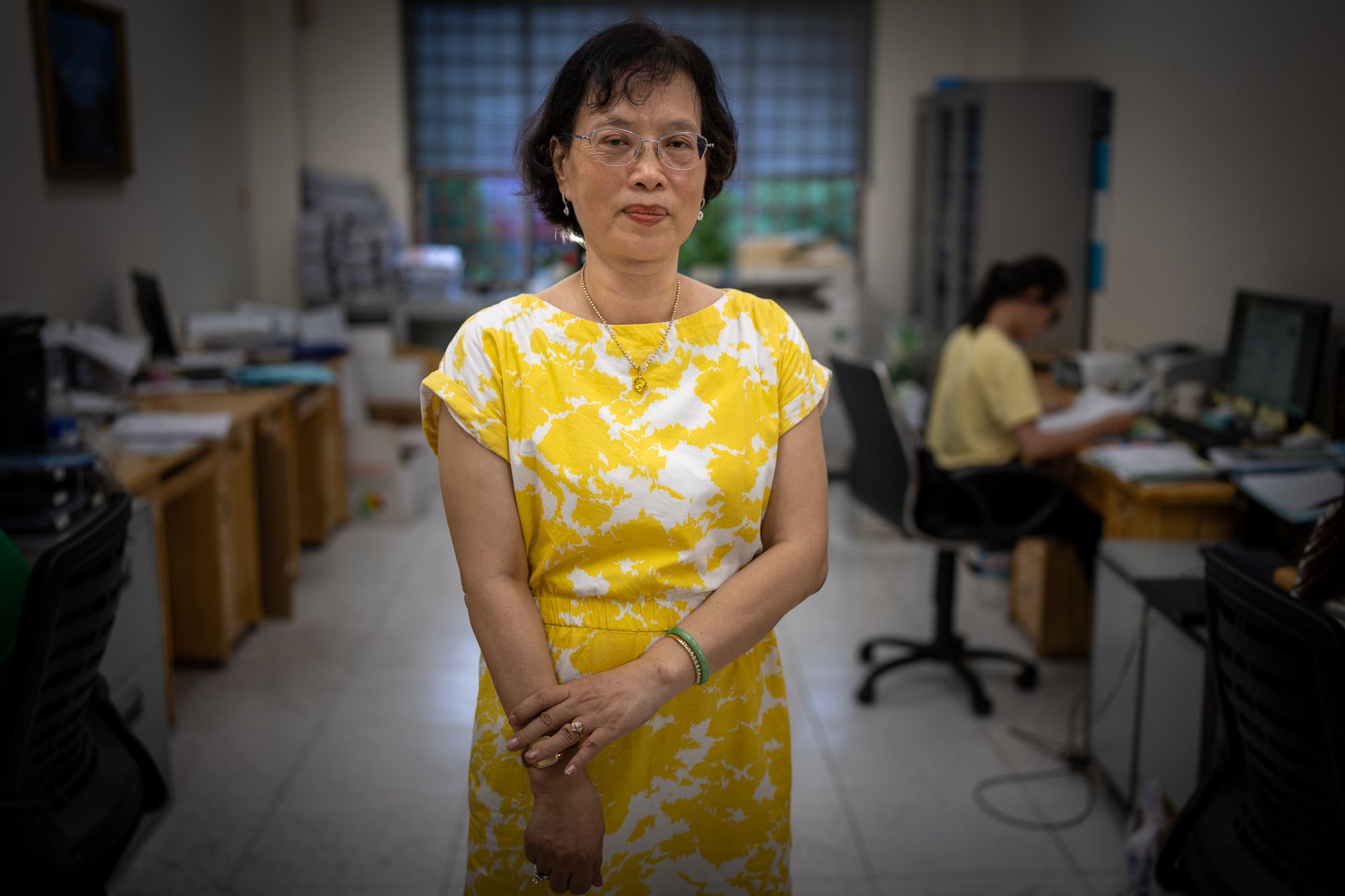

Lan's Story

Ho Chi Minh City, Viet Nam

After devoting two decades to a state-owned enterprise engaged in exporting raw cashew nuts from Viet Nam, Duong Thi Phuong Lan embarked on a new venture.

In 2005, she took the bold step of establishing her own enterprise—Dakao Agricultural Produce Export and Production - a pioneering cashew processing factory, the first of its kind in Viet Nam.

In the initial years, Lan's business thrived, but the 2008 global financial crisis dealt a severe blow, causing a downturn in cashew demand worldwide. Faced with substantial challenges, Lan contemplated selling her company.

However, timely financial support from TP Bank in Viet Nam proved instrumental in sustaining her business through the 2008 crisis and two subsequent global financial downturns.

Despite the setbacks, Lan persevered, continuing to export her processed cashews to various international markets.

Today, her company stands as one of the most successful in Viet Nam, with a strong presence in European and American markets.

To meet soaring demand, Lan expanded operations by importing cashews from Cambodia, Côte d'Ivoire, Ghana, Tanzania, Mozambique, Senegal, and Nigeria.

Notably, Lan's business has become a source of employment for hundreds of women and men, contributing to the economic uplifting of communities across the country.

With support from IFC’s client TP Bank, Lan has built one of Vietnam's most successful export manufacturing businesses, and provided jobs to hundreds of women. TP Bank is part of IFC’s Banking on Women initiative as well as the Women in Trade initiative under Global Trade Finance Program (GTFP). Lan’s company is the largest user of IFC’s Women in Trade Initiative globally and is utilizing GTFP to import cashews from African countries.

Since its inception in 2012, IFC’s Banking on Women program (BOW) has provided financial assistance and business expertise to female-owned SMEs through an innovative investment-advisory model. Collaborating with financial institutions, BOW designs customized value propositions that emphasize both financial and non-financial services to empower female entrepreneurs.

In 2019, IFC’s BOW and Global Trade Finance Programs joined forces to create the BOW Global Trade Finance Program. This Women in Trade initiative encourages banks to increase access to trade finance for female-owned SME entrepreneurs in emerging markets so that they can grow and expand their businesses. This program is supported by the Women Entrepreneurs Opportunity Facility (WEOF), a partnership launched by Goldman Sachs 10,000 Women and BOW. To date, more than US$260 million of trade finance support has been allocated by this partnership to support more than 233 women entrepreneurs around the world.

Since its launch, BOW has invested US$4.29 billion in emerging market financial institutions, making substantial strides with 251 projects across 76 countries. As the BOW business continues to break barriers and empower women globally, it remains a beacon of progress, setting new benchmarks for gender-inclusive financing.

Read more about IFC’s Banking on Women Global Trade Finance program here. Read more about IFC's Banking on Women program here.

Published March, 2024

"Women have it much harder than men in this world. You have to marry, have children, and work. Actually we go through a lot of things. If we want to be treated equal we need to claim our space. We need to study, research and gain knowledge."