New Technologies Powering the Energy Transition in Asia and the Pacific

By Alec Macfarlane

Alaminos, a small, agro-industrial town in the province of Laguna in the Philippines, is perhaps better known for its coconuts, rambutans, and surrounding natural springs than as a destination for clean energy innovation. But it is also home to a 120-megawatt solar farm, one of the country’s largest, which is co-located with a 40-megawatt energy storage facility.

The project, which is the Philippines’ first hybrid solar power and energy storage initiative, consists of 24 lithium-ion battery containers, and the solar farm can power around 40,000 homes and avoid roughly 110,000 metric tons of carbon dioxide per year. The project aims to enhance the grid’s stability and reliability by storing power when the sun is shining but demand for power is low, and feeding it back into the grid when demand is high.

"The solar farm can power around 40,000 homes and avoid roughly 110,000 metric tons of carbon dioxide per year."

“To really scale up and unlock the full potential of renewable energy, we need to also scale up battery storage,” said Eric Francia, President and Chief Executive Officer of renewable power generation company ACEN, the listed energy platform of the Ayala Group, an IFC client. ACEN owns the Alaminos project and has similar but more nascent initiatives underway at different stages in Australia, Viet Nam, Indonesia, and India.

“Whereas a coal plant can operate 90 percent of the time, a solar plant can only operate at a fraction of that because the sun doesn't shine all day. By overproducing while the sun is shining and storing that power in batteries, you can increase the capacity factor of a solar plant from below 20 to 60 percent.

“The Philippines faces the challenge of a lack of transmission capacity and the need to balance out the grid when renewables aren’t producing, and battery storage can definitely help address that.”

Battery energy storage is one of a handful of promising new technologies that will play a significant role in supporting emerging and developing economies in the energy transition in Asia and the Pacific, where many countries have set ambitious climate goals that cannot be achieved by public sector funding alone. The ability of batteries to store renewable energy and release it at a later point make them a key decarbonization tool, particularly as the cost of lithium-ion battery packs falls to record lows and the range of services they can be used for expands outside the scope of the electric vehicles sector.

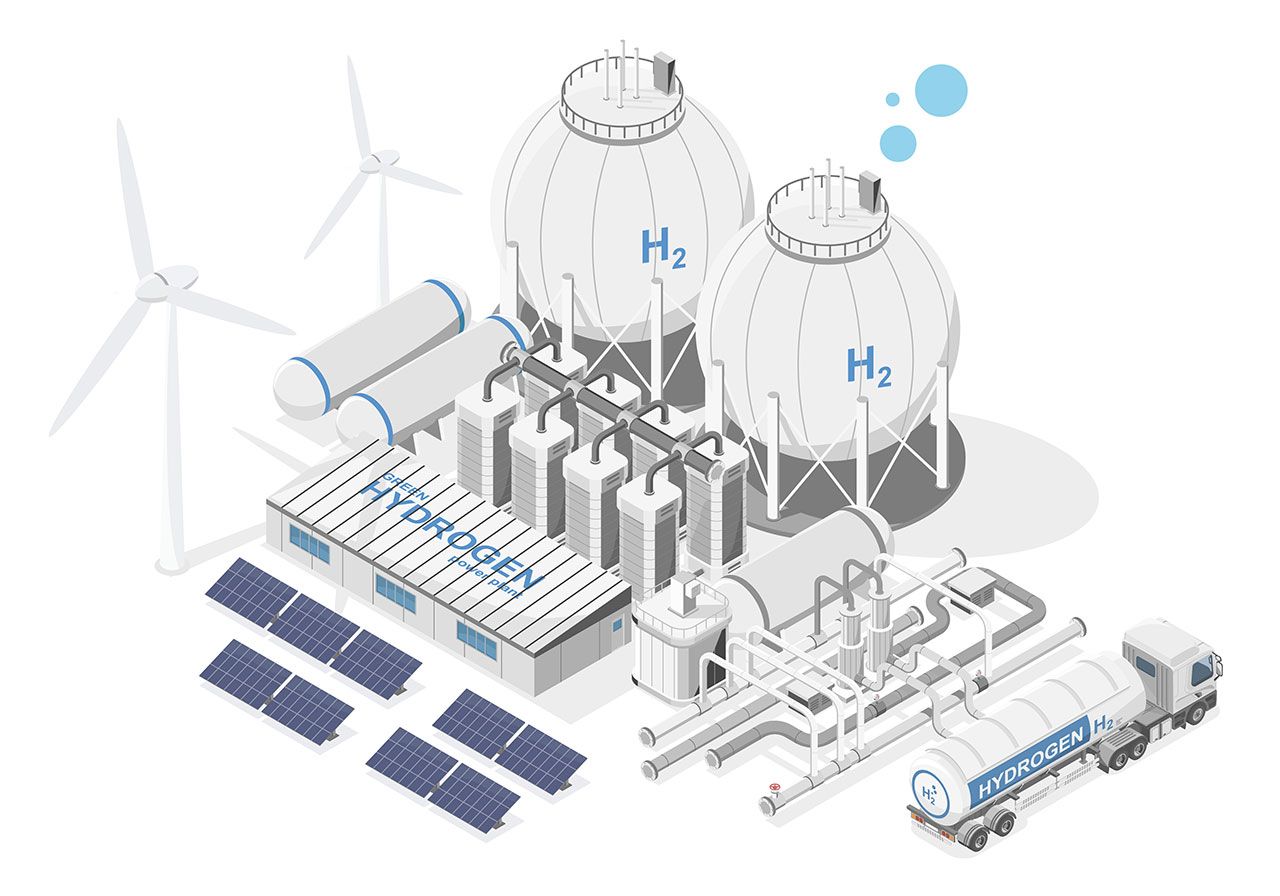

Green hydrogen, produced by splitting hydrogen from oxygen in water using machines called electrolyzers that run on renewable power, is another new technology enjoying political and private sector support across the region due to its potential to accelerate the transition. It can be produced and burned with zero emissions, helping to decarbonize hard-to-abate sectors such as power, mining, and long-haul transport, as well as heat-intensive industrial processes like metal smelting and refining.

Illustration showcasing a concept of a green hydrogen power plant. Photo: AdobeStock

Illustration showcasing a concept of a green hydrogen power plant. Photo: AdobeStock

While green hydrogen has yet to become fully cost competitive, energy companies, corporates, and institutional investors clearly see the potential. Gentari, a new renewable energy division of Malaysia’s Petroliam Nasional recently established as part of a push by the state-owned company to produce carbon-free energy, is currently developing green hydrogen facilities in Malaysia, Canada, and India. Also in India, renewable-power developer Avaada recently raised $1 billion for its green hydrogen and ammonia ventures from Brookfield, the world’s largest infrastructure manager.

“We are very actively looking at opportunities in green hydrogen around the world, including in India,” said Nawal Saini, a Managing Director in Brookfield’s Renewable Power and Transition Group based in Mumbai. “We continue to be very open about investing in some of these newer technologies, including green hydrogen, so long as it meets our investment discipline and the economics and opportunity justify it. This usually means a long-term offtake agreement for the hydrogen is in place, as well regulatory incentives, and a clear regulatory framework to be able to set these assets up at scale.”

New technologies are also making India’s grid greener and more efficient. IndiGrid, the country’s first and largest listed infrastructure investment trust in the electricity sector and an IFC client, operates electric transmission networks and renewable energy assets that deliver power throughout the country.

Power Transmission Tower in IndiGrid’s NER project. Photo courtesy: IndiGrid

Power Transmission Tower in IndiGrid’s NER project. Photo courtesy: IndiGrid

The company is currently exploring and investing in a number of emerging technologies including battery energy storage and high-voltage direct current technology, which allows for long-distance power transmission between power plants and the grid with limited energy loss. IndiGrid is also using cutting-edge technologies to digitalize the management of its assets, including advanced weather forecasting, satellite imagery, and drones to maintain reliable electricity transmission networks and minimize the impact of disruptions due to vegetation and natural events.

“As a country, we have established a vision for achieving a 500-gigawatt renewable target set for 2030,” said Harsh Shah, Chief Executive Officer at IndiGrid. “For this unprecedented scale of deployment for the energy transition, much more capital is needed in India for some of the new technologies where immediate viability or bankability may be challenging.”

The energy transition is a huge investment opportunity, and the fast-paced growth in investment in new technologies offers signs of more to come. Global investment in the energy transition hit a record $1.8 trillion in 2023, climbing 17 percent from a year earlier, according to BloombergNEF. There was strong growth in emerging areas, with investment in hydrogen tripling year-on-year to $10 billion, carbon capture and storage nearly doubling to $11 billion, and energy storage jumping 76 percent to $36 billion.

But while the capital is there, significant financing gaps exist in both green infrastructure and emerging and developing markets. As of the end of 2022, pension funds, insurers, and other non-bank financial intermediaries managed assets valued at $218 trillion. But according to the most recent estimates, institutional investors held just $1 trillion in infrastructure assets, excluding corporate stocks. Of these assets, just $314 billion, or 30 percent, were classified as green. To meet rising energy needs in ways that align with the Paris Agreement, annual investment, public and private, in clean energy in emerging and developing markets in Asia will need to nearly triple to as much as $1.7 trillion by 2035.

Substation in snow-laden terrain in IndiGrid’s NRSS project. Photo courtesy: IndiGrid

Substation in snow-laden terrain in IndiGrid’s NRSS project. Photo courtesy: IndiGrid

“The Asia-Pacific region faces significant challenges in the energy transition,” said Isabel Chatterton, Regional Industry Director for Infrastructure and Natural Resources, Asia and the Pacific at IFC. “While the investment opportunity is indeed big, the risks and challenges associated with investing in infrastructure in some of these markets, particularly in some of the newer technologies, are difficult for many investors to absorb.

“Getting the risk balance right is challenging in this region, which is why governments need to come up with the right incentives and policy frameworks to create enabling environments to attract private-sector investment into more bankable projects. By doing so, the more capital will flow into these markets, and the quicker the costs of these technologies will fall.”

While more blended, concessional, and catalytic capital as a means of crowding more investment into clean energy infrastructure in emerging and developing markets is needed, it is catching on. Brookfield recently announced the creation of a multibillion-dollar Catalytic Transition Fund, which will invest exclusively in emerging and developing markets around the world, including those in the Asia-Pacific region. The fund will receive up to $1 billion in catalytic capital from ALTÉRRA—a new $30 billion catalytic climate investment fund that aims to mobilize $250 billion globally by 2030 to finance climate projects.

“This fund allows us to invest in markets where traditional, large-scale capital hasn’t gone in at the pace that these markets demand, and it can also look at investments that have a higher risk threshold,” added Brookfield’s Mr. Saini. “Hopefully there will be more such capital available in the future to service what is clearly a massive requirement in emerging and developing markets.”

Eric Francia, President and Chief Executive Officer, ACEN. Photo courtesy: ACEN

Eric Francia, President and Chief Executive Officer, ACEN. Photo courtesy: ACEN

Nawal Saini, a Managing Director in Brookfield’s Renewable Power and Transition Group based in Mumbai. Photo courtesy: Brookfield

Nawal Saini, a Managing Director in Brookfield’s Renewable Power and Transition Group based in Mumbai. Photo courtesy: Brookfield

Harsh Shah, Chief Executive Officer, IndiGrid. Photo courtesy: IndiGrid

Harsh Shah, Chief Executive Officer, IndiGrid. Photo courtesy: IndiGrid

Isabel Chatterton, Regional Industry Director for Infrastructure and Natural Resources, Asia and the Pacific at IFC. Photo: IFC

Isabel Chatterton, Regional Industry Director for Infrastructure and Natural Resources, Asia and the Pacific at IFC. Photo: IFC