Cultivating Hope for Kosovo’s Farmers

The launch of agricultural insurance products in the country, supported by IFC, is boosting the sector and supporting farmers battling the impact of climate change.

In Teneshdoll, a village a few kilometers from Kosovo’s capital Prishtina, a young couple has rediscovered their passion for life. Teuta and Ekrem Rrahmani, now in their late 30s, decided to start an agriculture business in the raspberry value chain a decade ago.

Within a decade, their small 20-acre investment had expanded to six hectares, turning their vast fields a picturesque red. While their business has been growing, so have their children, who now help their parents in the farm. The business also hires 30 employees during the harvesting season.

Mrs. Rrahmani, 36, enjoys her work in the field. One of a small number of female farmers and entrepreneurs in Kosovo, she encourages other women to get into the sector. “Working in the raspberry value chain was challenging at first, until we learned how to cultivate this crop. Now we enjoy the benefits,” she says.

But they are also terribly aware of the climate challenges—in particular, the high temperatures—that can destroy their crop. One report shows that temperatures in the Western Balkans increased by an average of 1°C to 2°C between 1992-2020, with Kosovo a hotspot.

With that in mind, when Mr. Rrahmani heard about a new government scheme offering farmers subsidized agri-insurance products, he embraced the chance to insure their yield.

“This year, high temperatures damaged approximately 30 percent of our production,” he says. In previous years, they also experienced significant damages, affecting up to 70 percent of the yield, and causing around €150,000 in losses.

The couple sees agriculture insurance as the answer. “It’s an instrument for protecting our production. If you don’t insure your product, you will not receive any compensation for damages incurred,” says Mr. Rrahmani.

Having paid a heavily subsidized €57 for their policy this year, the couple saved more than €500, which they plan to invest to expand their business further.

Come rain or shine

The Kosovo Agri-Insurance scheme was established in 2017 as part of a joint project between IFC and Kosovo’s Ministry of Agriculture, Forestry and Rural Development (MAFRD). The aim was to establish an agricultural insurance system to support farmers and boost the development of the agriculture sector.

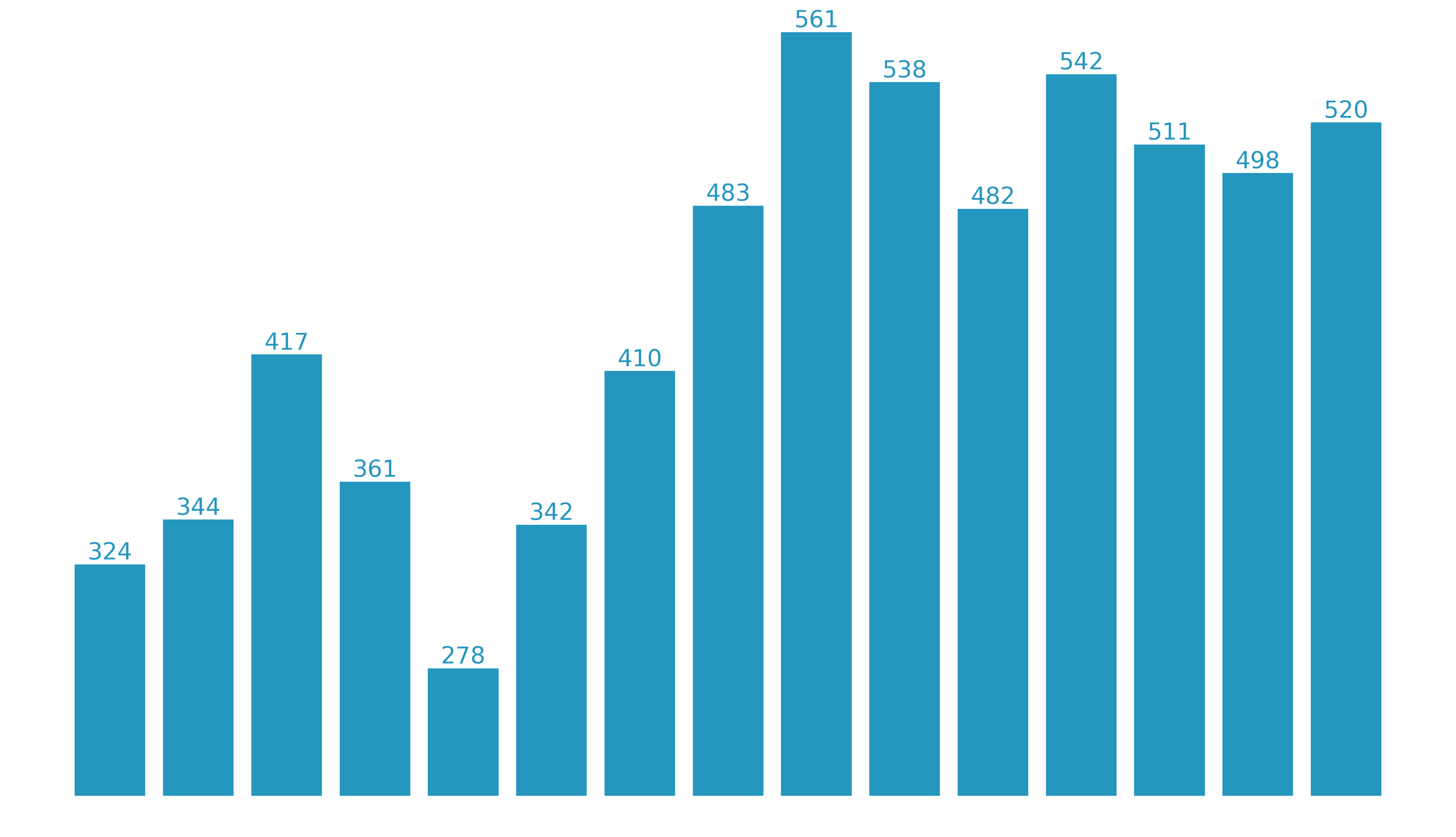

Agriculture, Forestry, and Fishing Value (2008-2022) for Kosovo in millions of 2015 US$. Source: World Bank

Agriculture, Forestry, and Fishing Value (2008-2022) for Kosovo in millions of 2015 US$. Source: World Bank

Agriculture is key in Kosovo, especially for the country’s rural population. More than half of the landlocked country is agricultural land, and this provides most of the food and jobs for rural dwellers, mainly through small family plots worked for subsistence. About half of the farmland is used for cultivating grain, potatoes, berries, and peppers; lush pastures and green meadows constitute the remainder.

As in many parts of the world, however, climate change threats loom—from rising temperatures to reduced or variable rainfall, and water shortages. According to the Kosovo Climate Change Strategy report, climate variability has already increased, with heat waves, droughts, floods, and forest fires becoming more likely. MAFRD says Kosovo’s agriculture lost an estimated €5.4 million in damages in 2022.

“Agriculture insurance builds confidence for financial institutions to lend, because the farmer has taken precautions to protect their business. Because of this, it’s an essential component in both growing agri-businesses and strengthening the financial sector.”

“Creating conditions that ease access to finance for local farmers and producers and help to mitigate climate-related risks are essential to unleash the potential of our agriculture sector. Enabling farmers to safeguard their crops and livelihoods is a big part of this.

Developing agri-insurance

All of this means Kosovo’s farmers, like many around the world, are desperately in need of agri-insurance to protect their crops. Until very recently, this was non-existent. Instead, the MAFRD compensated farmers for weather-related damages through ad-hoc payments, a non-transparent and often ineffective system.

IFC’s joint project with the ministry has been helping to change this. As part of the project, IFC supported MAFRD in establishing the legal infrastructure for the project and building its capacity to design tailored, subsidized insurance products, alongside an awareness campaign to encourage uptake.

The agricultural insurance products were introduced in 2018. From 2019 to date, Kosovo’s farmers insured a total of 552 hectares of agriculture land, with the total value of issued policies exceeding €1 million. The government is currently subsidizing 75 percent of the cost of each premium, and its commitment to the scheme is clear.

“Creating conditions that ease access to finance for local farmers and producers and help to mitigate climate-related risks are essential to unleash the potential of our agriculture sector,” says Faton Peci, Kosovo`s Minister of Agriculture, Forestry and Rural Development. “Enabling farmers to safeguard their crops and livelihoods is a big part of this.”

Pozzo says developing the agri-insurance system “was a complex and lengthy process involving multiple stakeholders. Only with a holistic approach could we build an efficient system where all participants would benefit and be able to effectively manage climate change impacts.”

Protecting Kosovo’s wine grapes

The Stone Castle Vineyards and Winery is among the largest agricultural businesses in Kosovo. Located in the heart of the beautiful Rahovec Valley, the company owns 2,246 hectares of arable land. This year, it insured 300 hectares of its vineyards—those at the highest risk of temperature change—to avoid continued weather-related losses.

Emrullah Spahiu, a vineyard manager, says the support from MAFRD with the 75 percent subsidy, and a further 10 percent covered by the local municipality, encouraged them to insure their yield. As he says, “agriculture insurance creates a secure environment for agriculture activities and for further investments.”

This year, the company experienced over 60 percent losses in production due to heavy rains between May and July. They did not receive any compensation, however, as their index insurance covered only spring frost, demonstrating that the nature of extreme weather events is not always predictable.

Despite that, the company considers agriculture insurance crucial to protect their business – though Spahiu has ideas for some changes to the current system, including better access to damage evaluations. “Currently, we don’t have access to the evaluation, he says, “so it would be good for a more transparent process to be installed.”

A force for change

“I believe farmers should not treat the state as a cash machine to withdraw money from. Losses they face due to weather factors should be covered by insurance premiums.”

Alban Shabani was among the first farmers in Kosovo to buy weather-based agriculture index insurance. The former civil servant is an invigorating force in the sector. In 2017, in his mid-twenties, he decided to leave his job at the Ministry of Foreign Affairs to establish an agri-business called Joni-Sh.

Making use of the family’s inherited land in Ballofc village in northeastern Kosovo, he first planted 60 acres of raspberries for domestic consumption. The following year, he invested in refrigerators to preserve his crop and established a collection point. His business expanded fast.

Today, his company has 300 contracted farmers, collecting around 400 to 600 tons of raspberries a year. The vast majority is exported to the European market, generating an annual net turnover of up to €1.7 million, and creating around 3,000 jobs in the surrounding area in the summer season.

Shabani purchased the agri-insurance premiums not just for his own orchards, but also for 30 contracted farmers. This year, all the area’s raspberry farmers were affected by high temperatures, and they all received indemnity payments.

He sees agriculture insurance as an important instrument to ensure continued success. Next year, he plans to cover a quarter of the cost for a further 300 local raspberry farmers, while MAFRD subsidies the rest.

“I believe farmers should not treat the state as a cash machine to withdraw money from,” he says. “Losses they face due to weather factors should be covered by insurance premiums.”

Published January 2024