Vanuatu a Step Closer to Becoming a Cashless Paradise

On the tiny island of Ifira, cash is still king.

But an agreement between banks is changing how everyday transactions are done by people living on Ifira and other islands across the Vanuatu archipelago, taking the South Pacific nation a step closer to becoming a more cashless society.

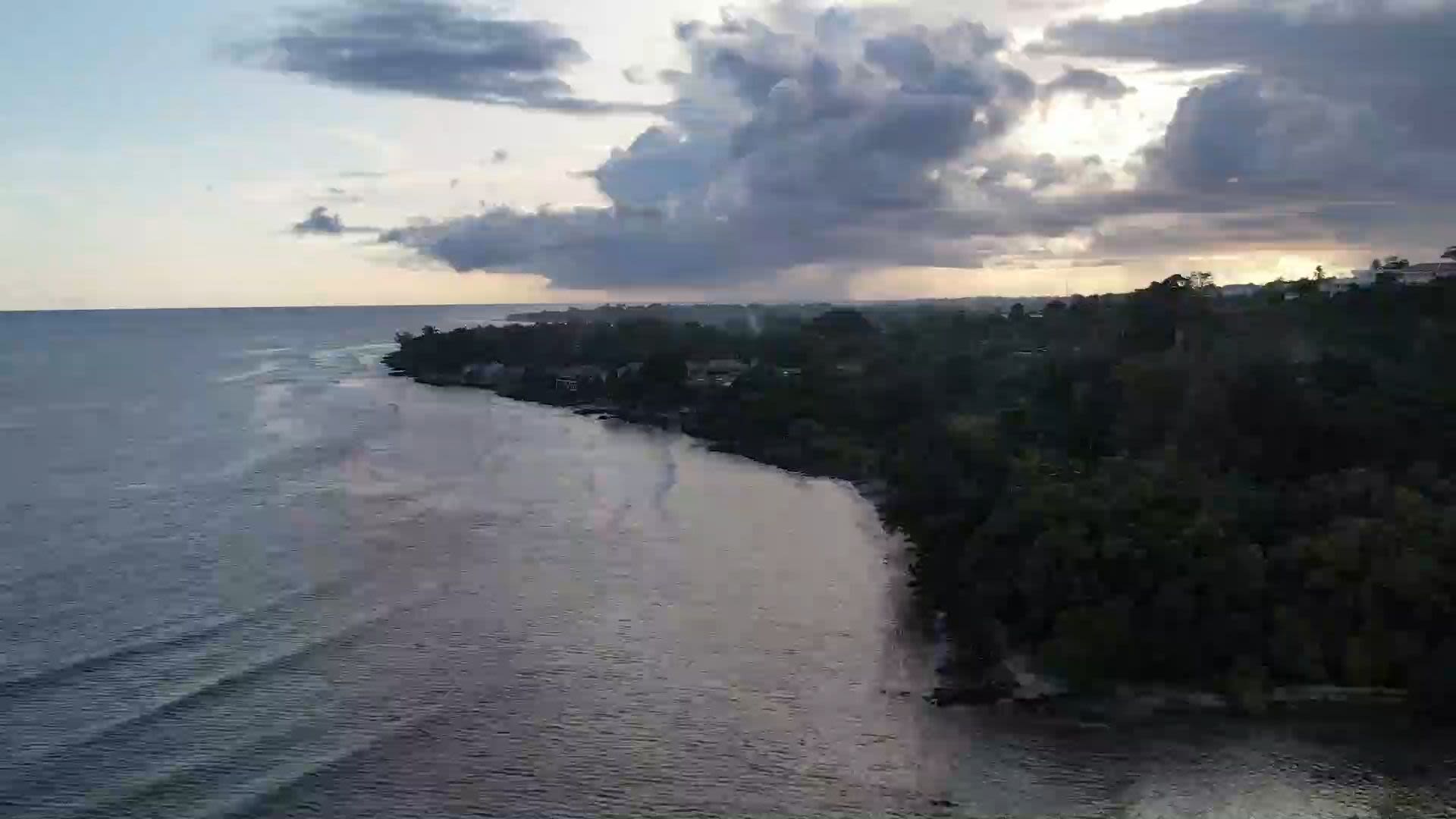

Ifira, which spans little more than half a mile from one side to the other, is like the other 80 or more islands that make up Vanuatu. It’s an idyllic place to live, with beautiful beaches and friendly people.

Christelle Kalsakau, second from right, rides a small boat on her way to work.

Christelle Kalsakau, second from right, rides a small boat on her way to work.

Paradise, though, can have its drawbacks, according to Christelle Kalsakau, who as the sun starts to rise, prepares to climb aboard a small boat on her way to work. While it’s only a 15-minute trip to Vanuatu’s main island of Efate and the capital Port Vila, it can seem like a world away if you find yourself marooned with no cash.

“Once I finish work, I need to go to an ATM, get some cash and then catch a boat back to the island and make sure that I do have enough money to come back to town the next day.”

– Christelle Kalsakau

“I have to plan ahead,” says Kalsaku, who lives on Ifira but commutes most days to Port Vila where she works as a medical receptionist. “Once I finish work, I need to go to an ATM, get some cash and then catch a boat back to the island and make sure that I do have enough money to come back to town the next day.”

It used to be a lot harder. Buying groceries or even getting medicine would often mean hours in a long queue to get cash from an ATM. You could only use your bank card – whether it be a debit or credit card – with ATMs and EFTPOS (electronic funds transfer at point of sale) machines that belonged to your bank.

People here are now reaping the benefits of an initiative under which banks operating in Vanuatu have made their debit card and EFTPOS machines interoperable. It might not seem like a big deal – similar reforms happened in the United States almost 40 years ago – but it’s expected to be transformative for the nation’s financial sector. “This landmark reform will drive financial inclusion by allowing these payments and banking terminals to be located more efficiently around Vanuatu,” said Geoff Toone, the former chairman of Bankers’ Association of Vanuatu, who was instrumental in pushing the reforms through. “It’s also a fundamental stepping-stone towards reducing the role of cash.”

“This landmark reform will drive financial inclusion by allowing these payments and banking terminals to be located more efficiently around Vanuatu.”

– Geoff Toone, Former Chairman of Bankers’ Association of Vanuatu

Vanuatu, a remote volcanic Y-shaped archipelago that stretches for about 800 miles across the South Pacific and ranked as one the happiest places in the world a couple of years ago, has traditionally relied on agriculture to provide the bulk of jobs for its population of about 300,000 people. Tourism, however, is playing an increasingly important role, with the modernization of its financial sector also seen as crucial to the island nation’s future economic fortunes. On top of that, a 2022 World Bank report underscored the importance of disaster resilience to the lives and incomes of its people and businesses and its ability to overcome risks associated with large external shocks that have long shaped its economy.

Women have been traditionally excluded from access to finance in Vanuatu. In 2018, the percentage of women with a bank account was just 32%. The project is aiming to lift this to 50%.

Vanuatu is a remote, volcanic Y-shaped archipelago that stretches for about 800 miles across the South Pacific.

Ultimately, widespread interoperability means the need for cheques and cash will be greatly diminished, as will associated credit and fraud risks. Banks will enjoy lower cash handling costs while the agreement is expected to improve demand for bank accounts, boosting financial inclusion. Businesses, including in the tourism sector, will also benefit.

Crucially, the reform, which is part of the IFC's Pacific Payments Project, is set to support women’s economic empowerment and financial independence, for which access to banking services is an important precondition. Women have been traditionally excluded from access to finance in Vanuatu. At present the percentage of women with active cards is 32%. The project is aiming to lift this to 50% by this year.

Vanuatu’s caretaker Finance Minister the Hon. Johnny Koanapo, who was Finance Minister when interviewed prior to Vanuatu holding a snap election on October 13, said, “It helps to create the efficiency and convenience, and I think that’s what people want.”

“It helps to create the efficiency and convenience, and I think that’s what people want,” said Vanuatu’s Caretaker Finance Minister, the Hon. Johnny Koanapo, who remembers when it was not so easy.

The transition towards a more cashless society has been timely, Koanapo said. Back in March, the people of Vanuatu endured a series of lockdowns amid outbreaks of COVID-19. Domestic travel was halted. The restrictions only underscored the value of contactless payments. “It’s important to have the efficient system and in times of COVID it helps,” Koanapo said.

It’s not just consumers who have benefited. Businesses, from large-scale industries to micro, small and medium enterprises, tourism operators and farmers have welcomed the reforms.

Bruno Crowby, a third-generation farmer, says the benefits, in practical terms, have been huge. Prior to the reform, seemingly simple but crucial tasks like buying fertilizer or seeds were incredibly time consuming, and more costly.

“My grandfather, he has to go and walk around with cash, all day,” said Crowby. “Now, there is no need for us to go to the bank, we’re not losing time on queue lines, we’re not wasting a day in town. We just go to the ATM and then we come, we do what we have to do, continue with the business,” Crowby said.

As the first project of its kind in the Pacific Islands, iteroperability offers an important demonstration case for other countries, in a region where many elements of banking systems need to be updated to bring them in line with international norms, unlocking economy-wide gains.

“This project marks a remarkable step forward in providing improved access for people in Vanuatu to the banking network, which is something people in more developed countries take for granted,” said Judith Green, IFC Country Manager for Australia, New Zealand, Papua New Guinea and the Pacific Islands. “Ultimately, this important project will help bring down costs for consumers and businesses and offer people the opportunity to access new products and services. We are grateful for the support of the governments of Australia and New Zealand for our innovative work to modernize Vanuatu’s financial system,” she said.

While there probably won’t be an ATM on Ifira anytime soon, Christelle is not too worried. For her, Vanuatu is the happiest place in the world. And now, instead of taking hours, her daily banking is now just a short walk after she gets off the boat, meaning she has more time to enjoy the best of paradise. “It makes life very easy,” she said.

Published October, 2022