EMERGING MARKET INSIGHTS

How Business Accelerators Can Boost Startup Growth

By Santiago Reyes Ortega and David Harrison

Accelerators offer mentorship, networks, and funding to entrepreneurs. That can make their firms more productive.

A good business idea can strike anywhere. But where it lands often determines how easily it can be turned into a thriving business.

Promising firms are more likely to thrive and grow in advanced economies than in emerging markets. Studies have found that young firms in Colombia, Mexico, and India grow more slowly than those in the United States, and they are less likely to develop into superstar companies.

The gap widens further: 44 percent of funded firms in high-income countries secure follow-up investments, compared to 34 percent in developing countries. But success is not just about financing—it requires know-how, networks, and market visibility.

These barriers can hold back economic growth. New, dynamic firms make an outsized contribution to job creation and productivity growth. Nurturing successful young businesses is fundamental to economic development in emerging markets.

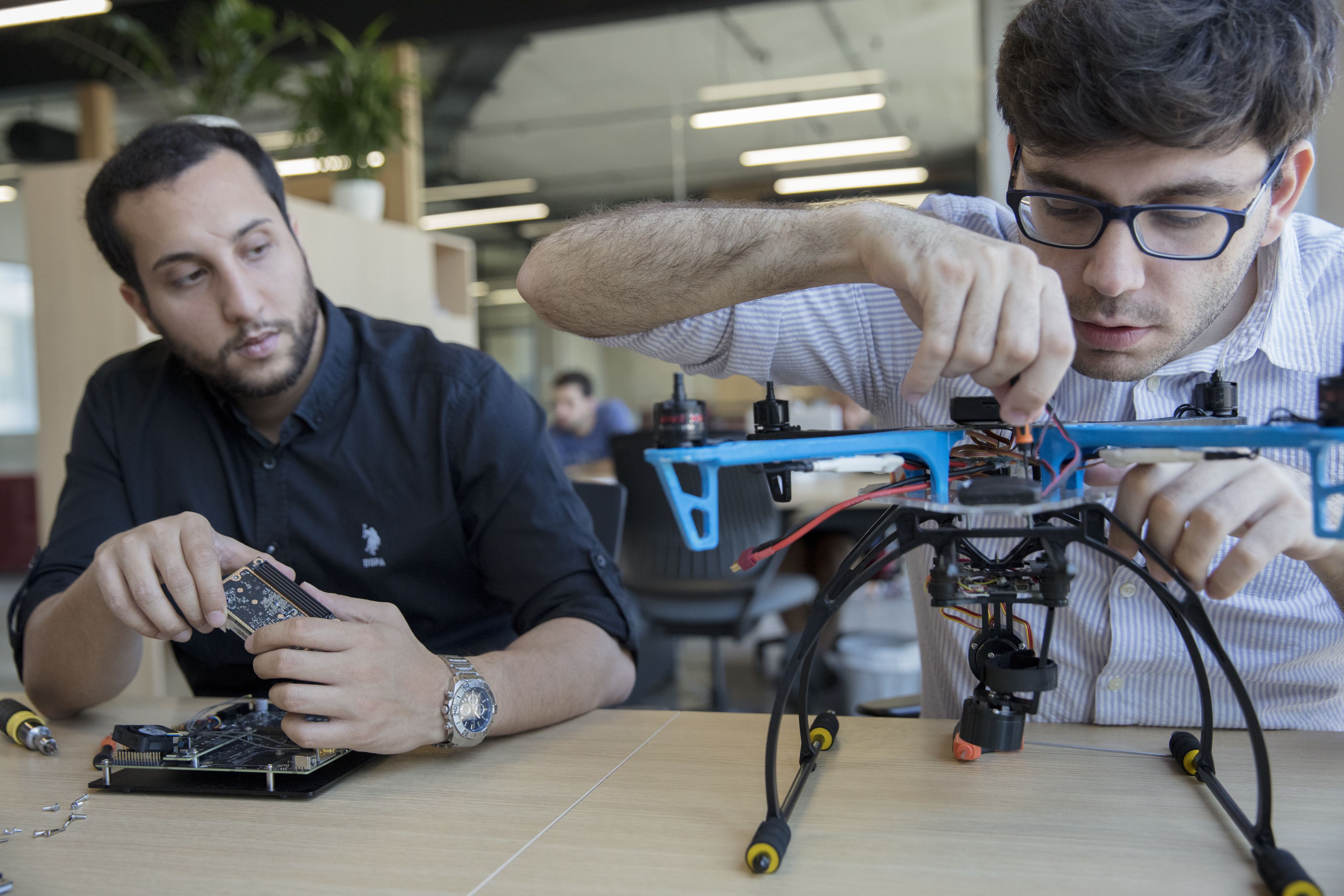

Business accelerators offer a promising solution. Accelerators scout for high-growth potential entrepreneurs and provide training, mentorship, and networking, often alongside seed capital. They help entrepreneurs grow their business faster, or recognize when their ideas are not viable, encouraging them to pivot or exit the market. Successful participation in recognized acceleration programs also signals quality to investors, helping promising firms secure additional funding.

Breaking Growth Barriers: Evidence on Business Accelerators

Recent research shows accelerators can unlock startup potential in emerging markets. Beyond capital, accelerators equip entrepreneurs with networks and intangible skills such as market understanding and decision-making. Their impact also extends to the startups’ employees, helping them boost their skills and future earnings. However, not all programs are the same. Accelerator effectiveness hinges on organizational practices, selection criteria, and incentives.

Accelerators' holistic approach tackles multiple challenges entrepreneurs face in developing countries. Evidence from a government-led program in Chile, which offers funding and shared workspace to all participants plus acceleration services to a select few, shows strong results: Entrepreneurs who barely qualified for acceleration raised three times as much capital and doubled their workforce compared to similar entrepreneurs who barely missed the cut. On the other hand, firms that received only funding showed no significant difference in performance over those that received no support.

The benefits extend beyond financial support. Evidence from a business acceleration program that provides training, mentorship, visibility, and networking—but no funding—also shows enduring results. Three years after acceleration, participating startups had grown sales 2.7 times faster than comparable firms excluded due to biases in the selection process.

The research revealed that experts' individual scoring biases can significantly affect which startups join acceleration programs. Some judges consistently grade more strictly or leniently, leading to the occasional rejection of high-potential ventures and acceptance of weaker ones. Accounting for these evaluation biases proves fundamental for accelerators' core mission of identifying promising entrepreneurs.

Follow-up research reinforces the importance of the selection process. Accelerators excel at helping high-potential startups overcome growth barriers rather than transforming average ventures into high performers. Successful accelerators evaluate multiple dimensions—from entrepreneur and team characteristics to business ideas—while identifying ventures' most pressing needs.

Accelerators’ influence extends into the broader economy through the startups’ employees and the dynamism of the entrepreneurial ecosystem. Novel data on skills and career trajectories show that employees at high-growth potential firms develop valuable cross-functional skills (working across multiple areas of the firm) and move out of technical roles and into more managerial and entrepreneurial positions. These skills are rewarded in the labor market after they leave the startup, earning 8 percent more in wages. This premium jumps to 15 percent for accelerated startup employees, suggesting accelerators' knowledge and networks benefit both firms and their workforce.

Skill development on employees could spread through emerging economies. As accelerator-trained workers move to other firms, launch their own ventures, or nurture new talent, they spread valuable capabilities across the business landscape. Such knowledge diffusion could help promising young firms establish themselves more readily in emerging markets, making the overall economy more productive.

U.S. evidence shows accelerators in nascent startup hubs help develop early-stage financing by attracting new local angel investors and venture capitalists. Moreover, ventures from more developed ecosystems show higher success rates, suggesting a virtuous cycle in entrepreneurship development. While promising, these ecosystem effects need further study in developing economies.

Maximizing the Impact of Business Accelerators in Developing Countries

Business accelerators have expanded rapidly across developed and developing countries, with governments and aid agencies spending more than $1 billion a year on training entrepreneurs.

But accelerators come in diverse models and vary widely in their effectiveness. Corporate accelerators seek industry-specific solutions, while programs backed by investors, universities, and public funding focus on broader goals. Their offerings range from seed capital to network access and expertise. This diversity raises questions about which approaches work best in different developing market contexts.

Recent evidence underscores how these differences shape outcomes. A study of 408 accelerators across 176 countries reveals that while accelerator programs generally deliver positive results, their impact varies significantly based on participant selection and services provided. Early-stage companies benefit from gaining business know-how, while more mature companies value networking and access to investors.

In the United States, investor-sponsored accelerators help startups raise more capital and achieve higher valuations than government or non-profit accelerators. This pattern emerges in developing countries too. Data from Peru reveal accelerators with stronger private-sector ties implement more rigorous selection processes and better organizational practices, including performance tracking and peer learning. These advantages likely stem from investors' keen interest in identifying and supporting high-potential firms.

Limited investor base and financial market development in developing economies restrict collaboration with accelerators. Most funding in these markets comes from governments and aid organizations, creating incentives that may dampen accelerators’ potential impact. In Africa, for instance, 77 percent of entrepreneurs’ support organizations do not include growth potential among their selection criteria.

The IFC Startup Catalyst reveals potential approaches to tackle these challenges across development contexts. The program channels investments through 22 accelerators and seed funds, reaching 750 startups across 65 developing countries, including 14 in low-income and fragile countries. Portfolio data suggest that funds with accelerators, which combine funding with structured support, slightly outperform fund-only seed fund managers.

Working across different development contexts has also shaped the program's strategies. In emerging markets, accelerators perform better when they invest directly in startups, as this creates stronger incentives for success. In less developed markets, the program partners with accelerators from more developed neighboring countries to build regional business networks and connect promising startups with larger investor and private-sector networks.

Peru's accelerator program offers lessons from a public policy perspective. When launched in 2013, the government provided grants for new and existing accelerators. By 2018, officials shifted to a pay-for-performance model that tied grants to startups’ outcomes and accelerators’ organizational improvements. Under this approach, accelerators qualified for grants based on meeting specific targets like implementing rigorous selection processes with industry leaders, achieving external financing goals for portfolio companies, and helping startups reach sales benchmarks based on their development stage and industry, among others.

Finding the right balance between ambitious and achievable performance metrics was challenging, recalls Gonzalo Villaran Elías, former director of program development at Proinnovate, Peru’s government organization for entrepreneurship. However, the model shows promise: Accelerators have met over 70 percent of their performance goals while building stronger private-sector ties. Most now collaborate with venture capital firms and large corporations, identifying promising startups for investment opportunities and connecting them with businesses seeking innovation solutions or supply chain improvements.

These experiences and research show that accelerators can unlock growth when incentives are aligned and adapted to local market conditions. Less developed countries, with nascent financial markets, will benefit from plugging into regional investment networks. For lower-middle-income countries, priorities must shift to deepening local private-sector connections while nurturing angel investment networks and venture capital funds. Accelerators can focus on specialization and scale in more developed emerging markets—creating industry-specific programs, building cross-border networks for market expansion, and connecting local startups to global value chains.

Infographics by Irina Sarchenko, IFC

Emerging Market Insights is an article series covering business trends in emerging markets and developing economies.

It is produced by the IFC’s Economics and Market Research Department.

How to Bring More Meat, Eggs, and Dairy to Poor Countries

New technologies and business practices can make farms more productive, curb malnutrition, and reduce emissions.