ANNUAL REPORT 2024

ACCELERATING IMPACT

MOBILIZING INVESTMENT AT SCALE

IFC has one focus: private sector solutions to development challenges. We take on tough problems that governments alone can’t solve, providing business-based answers that are innovative, inclusive, and equip leaders with key tools for success.

This was a year of record results for IFC, demonstrating that integrating the power of the private sector with public sector reforms and development expertise is the most effective path to achieving sustainable, inclusive growth in emerging markets.

As we look ahead, IFC is uniquely positioned to lead the charge in reimagining development finance, scaling up impactful investments, and delivering transformative outcomes where they're needed most.

LEADERSHIP PERSPECTIVES

Letter from IFC Managing Director, Makhtar Diop

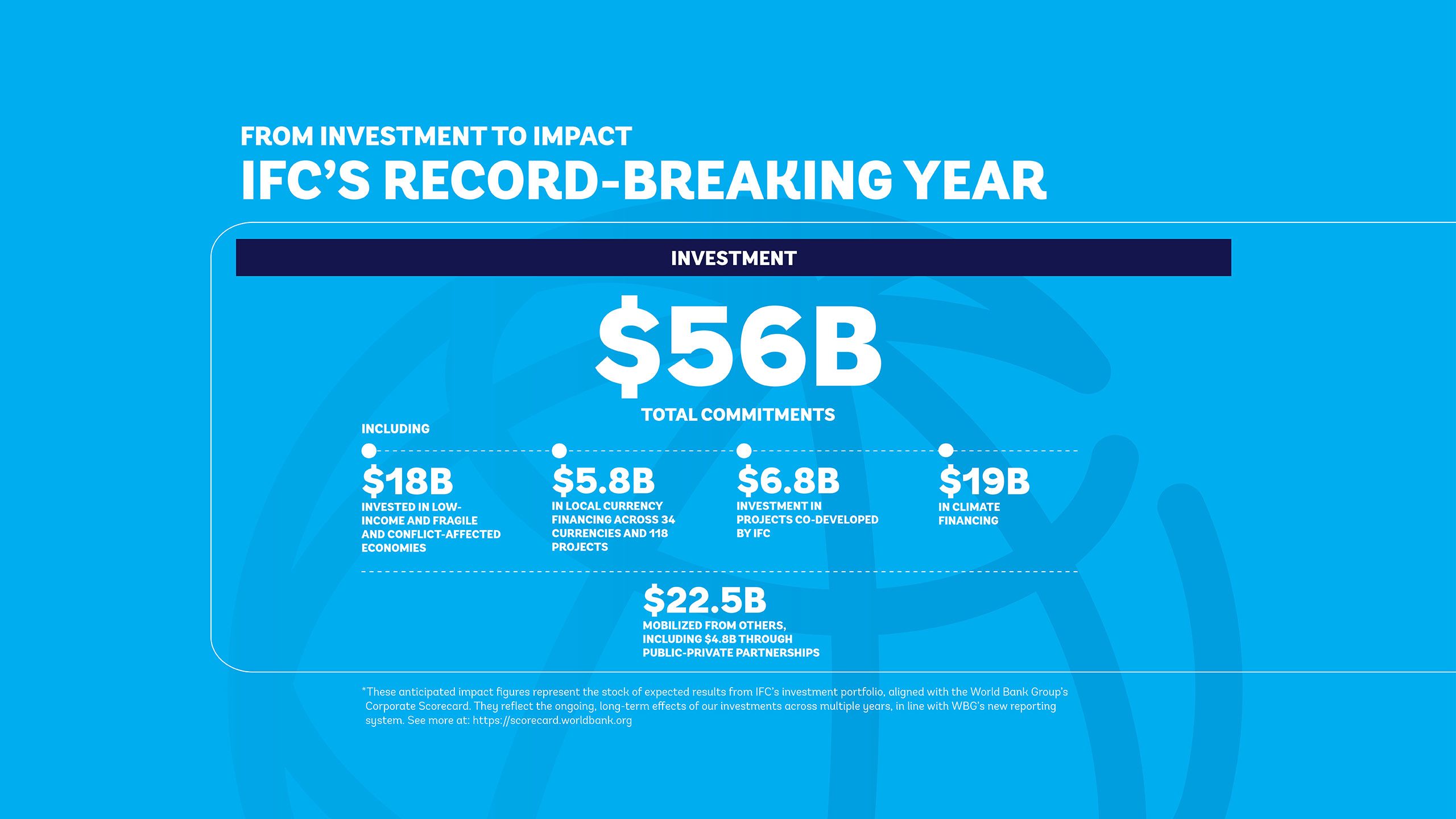

In FY24, IFC committed a record $56 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector in development.

Letter from IFC Board

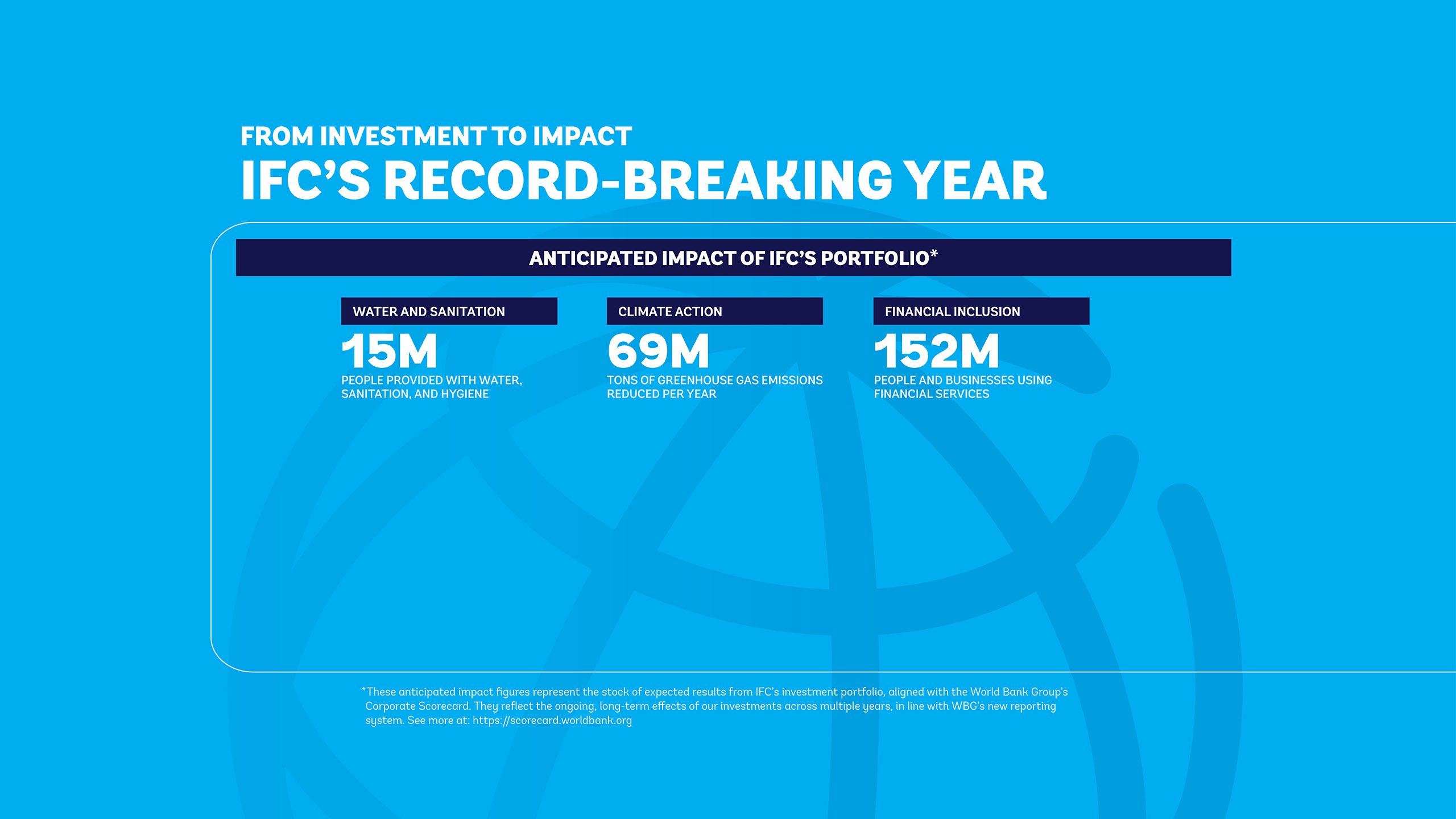

In all that we do, IFC seeks to maximize our development impact and improve our performance. The size and diversity of our investment portfolio — $80.2 billion for IFC’s own account — ensured that IFC achieved significant impact in nearly every region of the world.

Message from World Bank Group President, Ajay Banga

The World Bank Group provided much-needed financing; conducted in-depth analysis and research; and partnered with governments, the private sector, and other institutions to help developing countries address urgent needs.

STRATEGY IN ACTION

Accelerating Impact as Part of a Better World Bank Group

As we evolve into a Better World Bank Group to address compounding global crises, we’re not just adapting to change — we’re driving it, pioneering innovative solutions that harness the power of private enterprise to eradicate poverty on a livable planet.

From climate resilience to digital transformation, from gender equity to fragile states, we’re proving that commercial viability and development impact can — and must — go hand in hand.

FY24 marks a watershed moment, both for IFC and the entire World Bank Group. As we operationalize our new vision, we’ve sharpened our focus, pushing the boundaries of what’s possible in emerging markets. Our approach is multifaceted yet unified, seamlessly integrating our roles as investor, advisor, partner, and catalyst to create impact greater than the sum of its parts.

UNLOCKING CAPITAL

As a trailblazing investor, IFC is reimagining how private capital can be mobilized to build a better world. Our program growth is fueled by a singular focus: maximizing the impact of every dollar invested.

In an era of complex global challenges, we recognize that transformative change requires more than isolated transactions. That’s why we’re urgently developing new ways to efficiently channel private capital toward the world’s most pressing needs, creating a multiplier effect, amplifying our impact and accelerating positive change on a global scale.

We’re leveraging our unique position within the World Bank Group to deliver solutions that meet ambitious development goals. From mobilizing billions for climate action to empowering women entrepreneurs and helping stabilize fragile economies by creating jobs and opportunities, our investments are accelerating progress toward a more sustainable, inclusive, and prosperous world.

PATHWAYS TO PROSPERITY

IFC’s role extends far beyond that of a traditional investor. As an enabling partner, we are catalyzing change by fostering robust ecosystems for impactful private investment. Our approach is multifaceted and dynamic, leveraging upstream engagement on sector reforms, project development, advisory services, and our unparalleled convening power to accelerate positive outcomes across diverse markets and sectors. At the heart of our strategy is the recognition that today’s complex challenges demand collective action.

Our collaborations with a wide array of stakeholders serve multiple crucial functions: setting industry standards, shaping favorable investment conditions, reaching underserved communities, and targeting high-impact growth areas. By doing so, we’re not just facilitating investments — we’re building environments where private sector solutions can thrive and make the most significant difference in improving lives.

REIMAGINING DEVELOPMENT FINANCE

In our role as a catalyst for transformation, IFC is at the forefront of reshaping development finance and private sector engagement in emerging markets and developing economies. We harness the power of financial and technological innovation, leverage our global influence, and provide thought leadership to accelerate positive change at scale.

Our initiatives go beyond funding individual projects. By making the business case for innovative solutions, pioneering new models, and creating platforms that others can adapt and replicate, we’re igniting systemic change that ripples across entire sectors and regions.

From unlocking the potential of Africa’s digital economy to fostering global collaboration in sustainable finance and forging transformative partnerships among multilateral development banks, we’re driving a paradigm shift in how development challenges are addressed.

FINANCIAL REPORTING AND RESULTS

Photo: © Grand Egyptian Museum

Photo: © Grand Egyptian Museum

IFC Financials

In FY24, IFC committed a record $56 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector in development.

Photo: Courtesy of Amartha

Photo: Courtesy of Amartha

IFC FY24 Results and Impact

In all that we do, IFC seeks to maximize our development impact and improve our performance. The size and diversity of our investment portfolio — $80.2 billion for IFC’s own account — ensured that IFC achieved significant impact in nearly every region of the world.

Photo: Shutterstock

Photo: Shutterstock

World Bank Group Results

The World Bank Group provided much-needed financing; conducted in-depth analysis and research; and partnered with governments, the private sector, and other institutions to help developing countries address urgent needs.