Empowering Türkiye’s Women Entrepreneurs:

Driving Change and Creating Opportunities

In Türkiye, women entrepreneurs are breaking barriers, driving innovation, and creating jobs, despite facing significant challenges in accessing financing and resources. Two inspiring stories—those of Ayla Müstecaplıoğlu and Gökçe Duman—highlight the transformative power of entrepreneurship and the critical role of financial services in unlocking their potential.

Ayla Müstecaplıoğlu and Gökçe Duman are transforming their industries and creating jobs. From producing sustainable baby products to leveraging AI for marketing, their journeys showcase innovation and impact. With support from Garanti BBVA and IFC, they have overcome financial challenges to grow their SMEs, create jobs, and drive change.

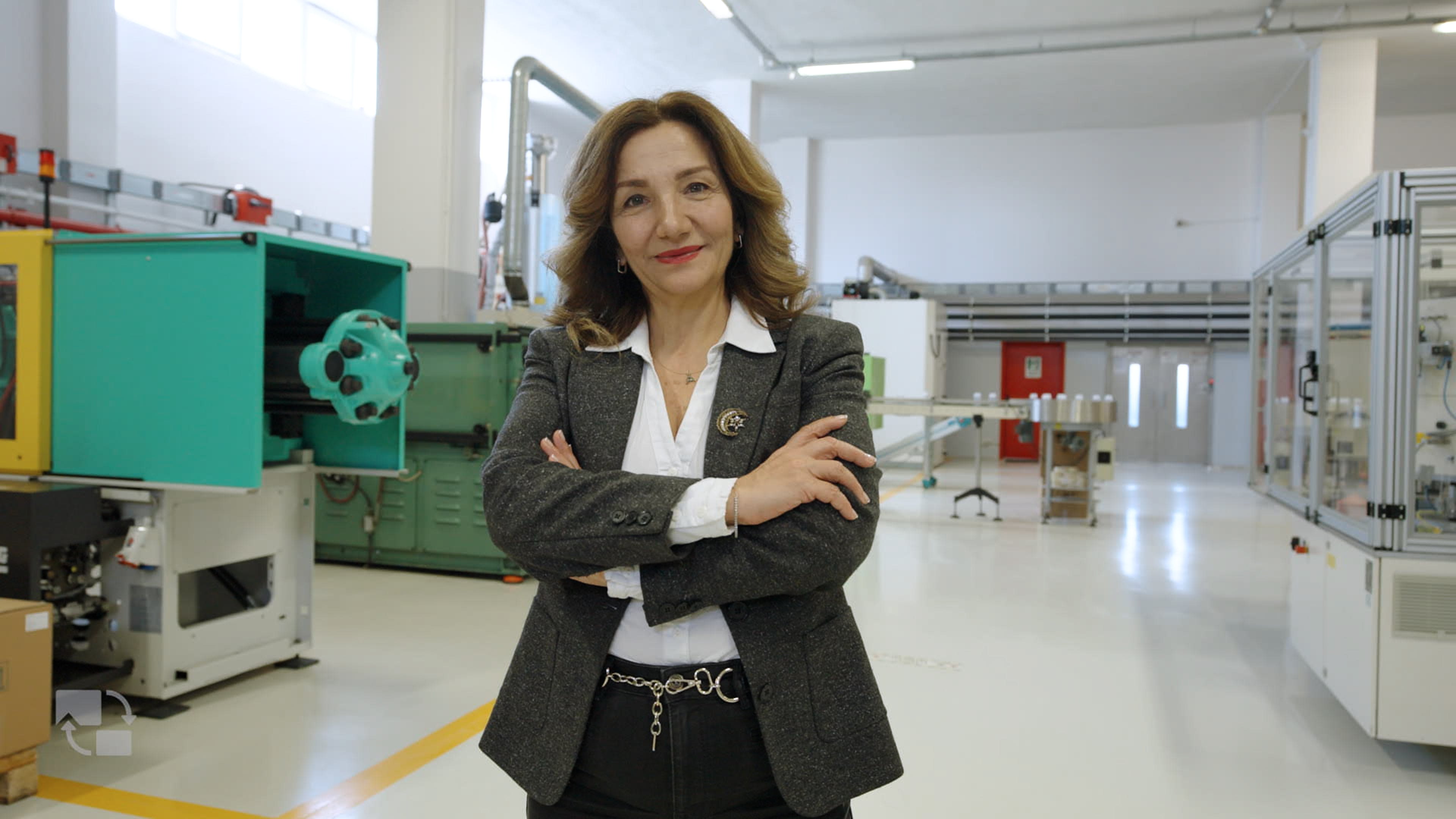

Ayla Müstecaplıoğlu: From Journalist to Groundbreaking Entrepreneur

Born into a rural family in Samsun, Türkiye, Ayla Müstecaplıoğlu moved to Istanbul to attend university. Her mother, a firm believer in the transformative power of education, encouraged Müstecaplıoğlu to pursue her studies and build a brighter future. Excelling academically, she became a successful journalist—but her entrepreneurial journey began when she became a mother in 1992.

“When I had my baby, I realized I could no longer work non-stop, day and night,” she says. “So, I decided to start my own business. As a new mom, I became interested in baby products and noticed that many of the items I’d seen abroad weren’t available in Türkiye. That sparked my interest in the sector.”

To address this gap, Müstecaplıoğlu initially began by importing baby strollers and car seats. Over time, she expanded her product line to include baby bottles, breast pumps, and pacifiers. In 2011, driven by a desire to create jobs and produce high-quality, reusable products for Turkish women, she decided to manufacture these products domestically. She repurposed an old manufacturing facility, aligning production with her commitment to sustainability and innovation. However, financing was critical to her vision.

Müstecaplıoğlu turned to Garanti BBVA, Türkiye’s second-largest private bank and a longstanding partner of IFC’s Banking on Women business, for a loan. The funding enabled her to invest in new machinery, automation systems, and sustainable packaging solutions. “Back then, baby bottle teats and pacifiers were sold in disposable blister packaging rather than storage boxes,” she explains. “For the first time, we introduced these products in reusable storage boxes.”

Mamajoo has created 44 jobs, including 27 positions for women, some of whom did not have previous educational or professional experience. Müstecaplıoğlu provides vocational training, empowering women to thrive in a supportive environment.

“I feel privileged to offer jobs to women living on the outskirts of Istanbul,” she says. “I knew they were struggling, and I wanted to help them. My biggest pride in life is creating jobs for people, particularly for women.”

My biggest pride in life is creating jobs for people, particularly for women.

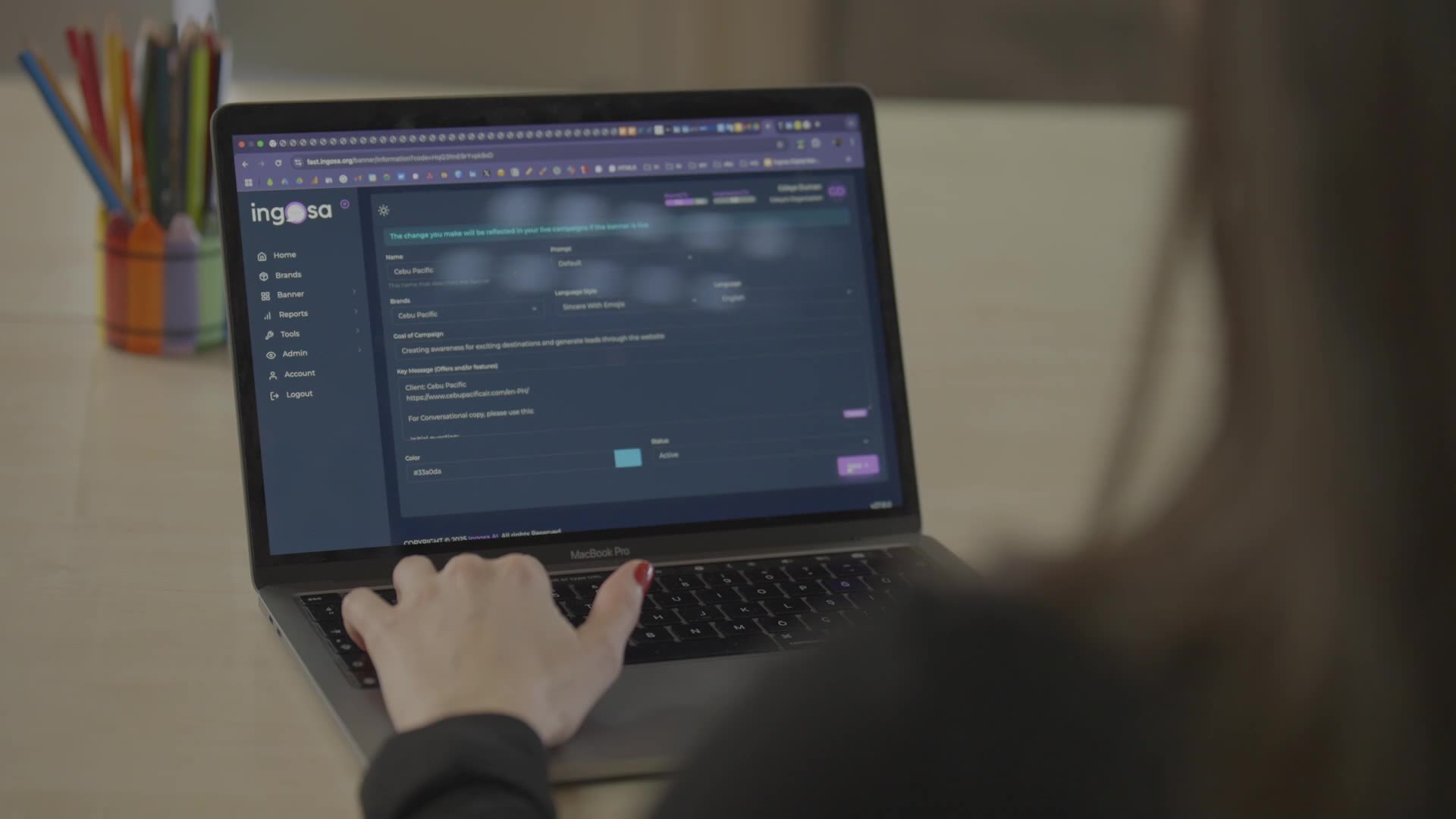

Gökçe Duman: Harnessing AI to Revolutionize Marketing

An engineer by education and digital marketer by profession, Gökçe Duman spent years working at digital marketing agencies before identifying a gap in the market: brands needed creative content that truly aligned with their identity, delivered quickly and efficiently.

In 2022, she co-founded Ingosa.ai, a tech startup that leverages artificial intelligence to automate creative marketing production. The company provides scalable solutions to meet the growing demand for digital content in a fast-paced, ever-evolving landscape. “Brands need creative marketing briefs today—actually, they needed them yesterday,” Duman says.

Despite its origins in Türkiye, Ingosa has gained global traction, working with 40 brands across 12 sectors, including finance, technology, and automotive. Starting with a team of three, the company has grown to 14 employees, half of whom are women.

Ingosa is a tech startup founded by women entrepreneurs, and we are proud to foster gender diversity within our team.

Accessing financing was one of the biggest hurdles Duman faced early on. “Startups and smaller businesses often encounter barriers that make it difficult to secure the funding they need to grow and scale,” she explains. In 2022, she applied for financing from Garanti BBVA, which enabled her to expand her team, sustain operations, and attract new clients.

Today, Duman is optimistic about the future, viewing AI as a tool to enhance productivity and create new opportunities. “Instead of seeing AI as a threat, we should view it as a companion to eliminate repetitive tasks and free up time for human interactions and strategic thinking,” she says.

The Bigger Picture: Unlocking Opportunities for Women Entrepreneurs

Smaller businesses like Mamajoo and Ingosa form the backbone of Türkiye’s economy, generating 40 percent of value-added, 35 percent of exports, and more than 70 percent of jobs. Yet, access to financing remains one of the biggest challenges they face. In Türkiye, the financing gap for micro and smaller businesses stands at 9.3 percent of GDP—approximately $80.3 billion—disproportionately affecting youth, women, and rural businesses.

Women entrepreneurs face even greater hurdles than their male counterparts due to factors such as lack of collateral, gender biases, and limited financial literacy. Many rely on personal savings or informal loans to start and grow their businesses.

Despite representing 8–10 percent of all entrepreneurs, women face a notable gender gap in business ownership and workforce participation. Only 16 percent of firms in Türkiye are owned by women, compared to 35 percent in Europe and Central Asia. Labor force participation is similarly low, with only 37 percent of women actively participating compared to 72 percent of men.

IFC’s longstanding partnership with Garanti BBVA includes investments aimed at addressing these challenges. In 2018, IFC’s Banking on Women business and Garanti pioneered Türkiye’s first gender bond—the first emerging-market, private-sector bond dedicated to financing women-owned and women-led enterprises. Conducted in partnership with the Women Entrepreneurs Opportunity Facility and Goldman Sachs’ 10,000 Women initiative, the bond provided crucial financial support to 10,000 women-owned SMEs.

Garanti BBVA Deputy General Manager Sibel Kaya says the bank is “committed to reducing the barriers faced by women entrepreneurs and ensuring equal opportunities. Increasing women entrepreneurs in the economy will create not only individual but also societal transformation.

Through our programs and products that empower women, we promote gender equality both within our organization and in society at large.

Momina Aijazuddin, IFC’s Regional Industry Head, Financial Institutions Group for the Middle East, Central Asia, Türkiye, Afghanistan, and Pakistan, echoes this sentiment. "By providing women with equal opportunities to access financial resources, we are unlocking their potential as entrepreneurs, job creators, and change-makers,” she says.

“It is not just about financial inclusion; it is about empowering women to shape their own destinies and paving the way for a more inclusive and equitable future."

Designed by Angela Njeri Mureithi

Published in June 2025