Empowering Ethiopia’s Entrepreneurs through Trade Finance

IFC’s Global Trade Finance Program (GTFP) is helping Ethiopian banks support local businesses and sustain livelihoods in rural and conflict-affected areas.

A fleet of trucks rumbles into MSA Trading’s factory 265 kilometers north of Ethiopia’s capital, Addis Ababa. Inside the factory, humming machines and hard-working staff assemble 160,000 polypropylene (PP) bags a day — each one made with recycled and imported materials. These sustainably made bags enable the transport of essential agricultural products, and other goods, like cement, throughout East Africa and beyond.

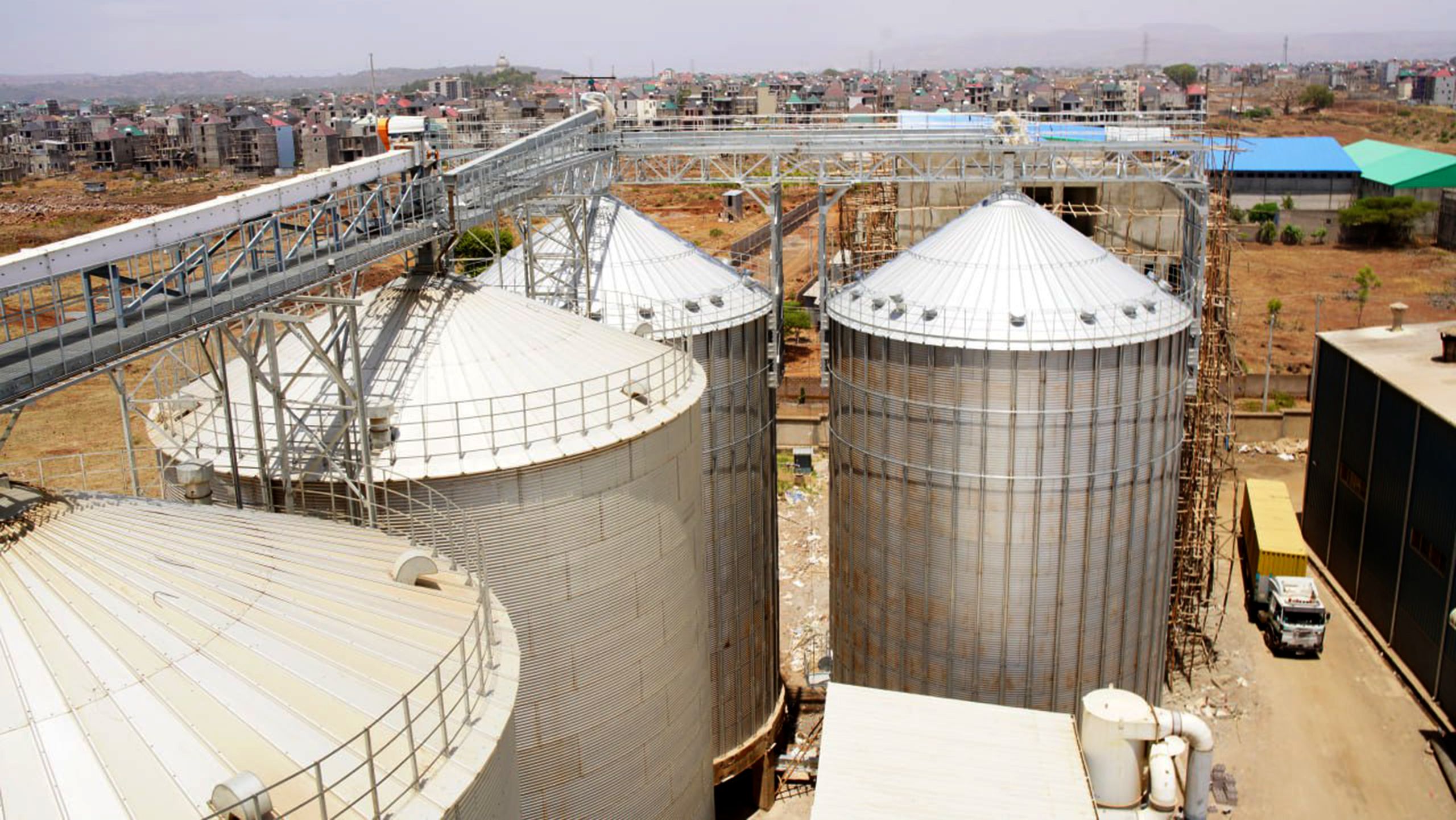

Founded in 1992, MSA is a major agro-industrial player in Ethiopia’s food and manufacturing ecosystem. Along with being the country’s largest supplier of PP bags, the company operates Ethiopia’s largest oilseed and cereal export business, and the second largest animal feed processing plant in Africa.

With factories located in North-Central Ethiopia, MSA creates much-needed jobs and economic opportunity in one of the country’s conflict-affected regions. Forty percent of its 2,000 employees are women, and the company works with a wide range of rural farmers, offering stable demand and above-market pricing for their crops.

Loading trucks outside the factory. Photo: MSA Trading

Loading trucks outside the factory. Photo: MSA Trading

MSA’s success and resilience through Ethiopia’s recent economic and political challenges are due in part to reliable access to trade finance through letters of credit provided by IFC client, Dashen Bank. “Being able to provide letters of credit to our international suppliers gave them the confidence to keep doing business with us, even during the most uncertain of times,” says MSA CEO Mulualem Alene. “Without these guarantees, we wouldn’t have been able to import the raw materials and machinery we needed to keep our staff employed and our operations going.”

Mulualem Alene, MSA CEO. Photo: MSA Trading

Mulualem Alene, MSA CEO. Photo: MSA Trading

Alene’s journey started with a bank loan of just $3,000 as a small cereal trader, before expanding into a multi-million-dollar manufacturing and logistics company. Today, MSA has over 150 corporate clients, supporting regional food security and advancing Ethiopia’s export ambitions. IFC’s trade finance support to Dashen Bank continues to help fuel that growth.

The company demonstrates how local entrepreneurship can transform lives, drive inclusive growth, and help emerging economies become more resilient. “Every job we create, every farmer we support, every bag we ship, is a step forward for Ethiopia,” said Alene.

While MSA's story highlights the transformative power of trade finance, the reality is that nearly 60% of African businesses still lack access to these financing opportunities. To help bridge the trade finance gap, now estimated at $90-$120 billion, the IFC has developed a comprehensive trade finance program servicing the continent.

Trade Finance – A Cornerstone of Economic Development

Trade and supply chain finance helps to ensure the uninterrupted flow of critical goods and services—like food, medical supplies, and raw materials. It reduces the risk between buyers and sellers engaged in cross-border trade by providing protection against partial (or total) non-payment, and improves working capital management for both parties. On a broader scale, trade finance helps sustain local,regional, and international economic activity, and value chain integration—particularly in critical sectors like agriculture and services, which are key drivers of employment and GDP in emerging economies.

However, while Ethiopia strives to deepen its participation in regional and global markets, businesses in the country continue to face severe constraints accessing trade finance. Local banks are often underserved by global banking networks due to several factors: the need to strengthen domestic banking practices and the limited risk appetite of international banks to operate in emerging markets—particularly in fragile and conflict-affected contexts. And while banking sector reforms are underway in Ethiopia, their impact may take time to materialize.

IFC Trade and Supply Chain Finance

That’s where IFC’s Global Trade Finance Program (GTFP) comes in. The GTFP extends and complements the capacity of international banks to provide trade financing in challenging markets, while connecting local banks, such as Dashen Bank, with IFC’s global network of international partners. This, in turn, empowers local banks to extend essential trade finance to companies like MSA—typically through IFC-guaranteed letters of credit. In Ethiopia’s import-reliant economy, these letters of credit are vital for doing business.

There are currently four GTFP issuing banks in Ethiopia—Awash Bank, Dashen Bank, Hibret Bank, and Zemen Bank—and this list is expected to grow as IFC expands its reach in the country. With IFC’s support, these banks are providing their clients with trade finance tools to better manage their working capital and grow their business.

“IFC’s GTFP is about more than just financing,” says Nathalie Louat, IFC Global Director for Trade and Supply Chain Finance. “We are also helping to create the systems, relationships, and in-country expertise necessary to allow trade to flourish. Through our trade and supply chain finance programs, countries such as Ethiopia can become more economically resilient by being further integrated into regional and international value chains.”

“IFC’s Global Trade Finance Program has enabled us to develop and strengthen our relationships with international banks,” said Asfaw Alemu, CEO of Dashen Bank. “This means that more Ethiopian companies are able to secure credit and import the goods they need to grow, create jobs, and remain resilient.”

Asfaw Alemu, Dashen Bank CEO. Photo: Dashen Bank.

Asfaw Alemu, Dashen Bank CEO. Photo: Dashen Bank.

The results are compelling. In just two years, the number of GTFP-supported letters of credit in Ethiopia grew from three in 2022 to sixty-five in 2024, increasing trade volumes for partner banks elevenfold. The program in Ethiopia now has an annual trade commitment capacity of $200 million— which is projected to grow by another $50 million next year—and has attracted an additional $60 million in co-investments from other Development Finance Institutions. This rapid scale-up is contributing to Ethiopia’s long-term economic reform agenda.

This year alone, the GTFP program has committed over $3.8 billion across Africa, partnering with approximately 75 local banks to support thousands of SMEs, and helping smallholder farmers reach broader markets.

“The Global Trade Finance Program can be a lifeline for businesses,” said Mary Porter Peschka, IFC Regional Director, Eastern Africa. “With support from innovative trade finance tools like IFC’s Global Trade Finance Program, MSA’s story demonstrates both tenacity and a model for other Ethiopian businesses to follow.”

A Broader Impact on Trade and Regional Integration

Beyond trade finance support, IFC is helping to strengthen the country’s financial sector. The program provides advisory services to help partner banks comply with global standards and implement best practices.

IFC’s additional programs – Global Supply Chain Finance program, Global Trade Liquidity Program, and Global Warehouse Finance Program—are also improving access to working capital, particularly for agribusinesses and SMEs across Africa. Together with the GTFP, these programs are playing an integral role in the continent’s agenda for local value creation, job growth, and economic transformation.

Made in Ethiopia

MSA’s growing trade network spans across Africa, Europe, Asia, and the Middle East, showcasing how Ethiopian companies are increasingly connecting with global markets.

From 2023 to 2024 alone, MSA generated over $40 million in export earnings– employing thousands, supporting regional food security, and advancing Ethiopia’s export ambitions. Looking ahead, Alene plans to open a canning factory, shifting from raw food exports to packaged goods, proudly labeled “Made in Ethiopia.”

“We want to contribute to Ethiopia’s reputation as a source of high-quality, value-added products,” says Alene. “And we want our products to reflect the resilience and ingenuity of Ethiopian businesses.”

Published, June 2025

Learn More